forc-it.ru

Tools

Can I Get Two Car Loans

What do I need to know about financing a second vehicle with Carvana? If you currently have a loan with us, financing another vehicle with Carvana is a. Most loans are approved in as little as 60 minutes. Blue mountain icon with flag on top. % Colorado. Local loan experts with experience you can. There is no limit to how many car loans you can have at one time. However, it might be difficult to qualify for more than one. This simple technique can shave time off your auto loan and could save you hundreds or even thousands of dollars in interest. In reality, rolling the balance of your existing loan into a new car loan is one of the most reckless and costly financial mistakes you can make. Here's the sad. Yes, you can sometimes combine the income from both jobs on your loan request form. Some lenders are willing to consider income from two jobs. Yes, it is possible to have two car loans at one time, although there are certain factors you must consider beforehand. You have two financing options: direct lending or dealership financing. Direct lending means you're borrowing money from a bank, finance company, or credit. You can have two car loans simultaneously if you can make the payments on both. However, it is important to consider both loans' interest rates and terms before. What do I need to know about financing a second vehicle with Carvana? If you currently have a loan with us, financing another vehicle with Carvana is a. Most loans are approved in as little as 60 minutes. Blue mountain icon with flag on top. % Colorado. Local loan experts with experience you can. There is no limit to how many car loans you can have at one time. However, it might be difficult to qualify for more than one. This simple technique can shave time off your auto loan and could save you hundreds or even thousands of dollars in interest. In reality, rolling the balance of your existing loan into a new car loan is one of the most reckless and costly financial mistakes you can make. Here's the sad. Yes, you can sometimes combine the income from both jobs on your loan request form. Some lenders are willing to consider income from two jobs. Yes, it is possible to have two car loans at one time, although there are certain factors you must consider beforehand. You have two financing options: direct lending or dealership financing. Direct lending means you're borrowing money from a bank, finance company, or credit. You can have two car loans simultaneously if you can make the payments on both. However, it is important to consider both loans' interest rates and terms before.

If you have two or more jobs, subprime lenders usually only accept your primary income for the minimum income requirement, but your other income could be used. Filling out several loan applications can lead to multiple hard credit inquiries, which can affect personal credit scores, potentially impacting a car shopper's. In short, they can shop around until they find a lender who will take you on even if you are a risk. But be warned: the terms of these loans often have pitfalls. Boat and RV Loans. Interested in purchasing a boat or recreational vehicle? With competitive rates on loans for boats and RVs, TFCU can get you one step. Yes, a person can apply for multiple car loans at various institutions at the same time. However, each bank will conduct a credit check on the. This loan can be used at authorized dealerships or to purchase from a private seller. Get the Details on New and Used Car Loans Loans-Insurance PSECU. The choice to lease or purchase a second vehicle is an important one. The good news? Both auto financing options have unique advantages that could make them. A lower credit score can make getting approved for an auto loan with competitive terms challenging. However, you could still be eligible for financing with a. Can I Have Two Title Loans on the Same Car? You can have two title loans at the same time, but you cannot have two title loans on the same car. If you have. Car loans for bad credit can help rebuild your credit and get you back on track. A Greater Nevada Credit Union car loan for bad credit can be the first step. You can have two car loans simultaneously if you can make the payments on both. However, it is important to consider both loans' interest rates and terms before. Yes, absolutely! While you might think you can only have one car finance agreement at any one time, the truth is that you can have as many loans as your chosen. Buying a car can be a significant investment, and sometimes, one car may not suffice. You may have different reasons for needing a second car, whether it's. Getting an auto loan for a longer term with lower interest rates might keep the monthly bill below a budget-busting level can be tempting but is that a good. Prepare Documentation – To get a 2nd chance car loan you will need to provide proof of employment, income and residence. It is helpful to have documentation in. Lenders will have DTI requirements and, if yours is too high, then you can create a strategy to pay down debt. Two types of consider include: Prioritize credit. Financing a second car loan is more common than you might think. There are several factors lenders look for when considering financing two or more vehicles at a. When you take out a car loan from a financial institution, you receive your money in a lump sum, then pay it back (plus interest) over time. The short answer? It's unlikely. Most loan contracts typically don't allow for transfers, and mainstream lenders generally refuse such a request. There are two. No Credit We know how difficult it can be to get a car loan with no credit history. 2. Review Your Financing Options. Our dealer partner will contact.

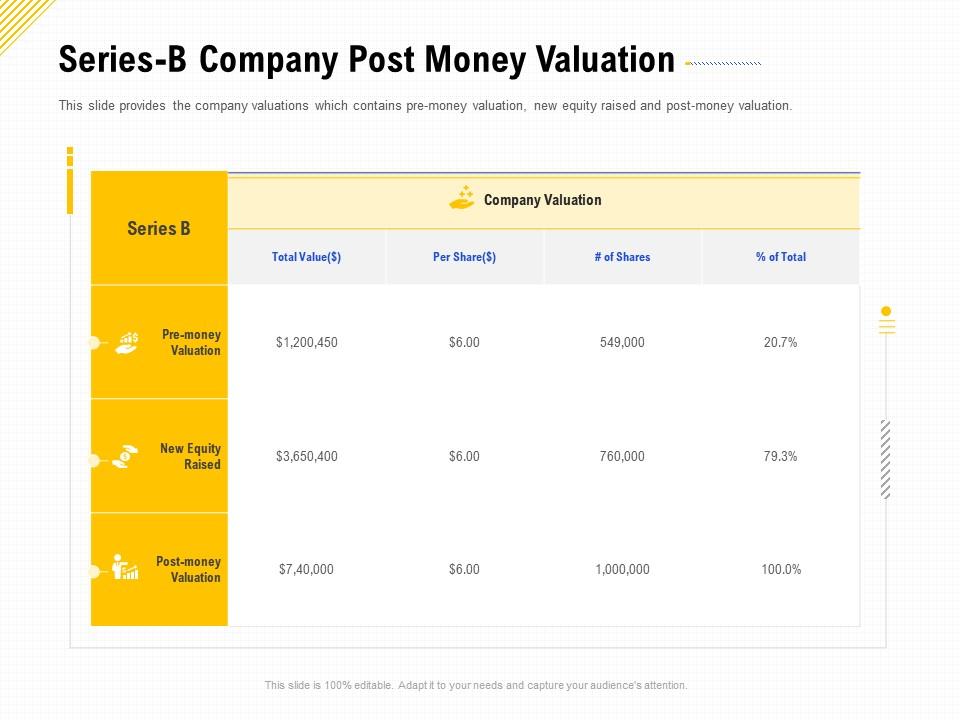

Series B Valuation

Series B funding is the second round of funding for a company, and it is provided by investors such as private equity firms and venture capital firms. Breaking down a deal. · Seed round: $K investment on a $1M pre-money valuation · Series A: $1M on $2M · Series B: $5M on $10M · Series C: $20M on $40M · Exit. The formula for calculating your Series B valuation for an immediate directional view of your company is: Multiplier x ARR x Annual growth rate x NRR x Gross. Series Funding is the initial financing round that a business receives from investors other than the company's founders. These outside parties. Series B rounds are about taking businesses to the next level, past the development stage. Investors help startups get there by expanding market reach. Zynga $M (). Industry: Gaming. Series B Investors: Kleiner Perkins Caufield & Byers Union Square Ventures Foundry Group Avalon Ventures Institutional. In Series B funding, startups are usually valued at $30 million to $ million. Purpose: The purpose of Series A funding is to scale the operations and expand. Beehiiv recently sent out an email to some (at least me), alongside their Series B announcement saying they had a 1m fund for customers to. Valuation: In Series A funding, startups are usually valued at $5 million to $30 million. In Series B funding, startups are usually valued at $30 million to. Series B funding is the second round of funding for a company, and it is provided by investors such as private equity firms and venture capital firms. Breaking down a deal. · Seed round: $K investment on a $1M pre-money valuation · Series A: $1M on $2M · Series B: $5M on $10M · Series C: $20M on $40M · Exit. The formula for calculating your Series B valuation for an immediate directional view of your company is: Multiplier x ARR x Annual growth rate x NRR x Gross. Series Funding is the initial financing round that a business receives from investors other than the company's founders. These outside parties. Series B rounds are about taking businesses to the next level, past the development stage. Investors help startups get there by expanding market reach. Zynga $M (). Industry: Gaming. Series B Investors: Kleiner Perkins Caufield & Byers Union Square Ventures Foundry Group Avalon Ventures Institutional. In Series B funding, startups are usually valued at $30 million to $ million. Purpose: The purpose of Series A funding is to scale the operations and expand. Beehiiv recently sent out an email to some (at least me), alongside their Series B announcement saying they had a 1m fund for customers to. Valuation: In Series A funding, startups are usually valued at $5 million to $30 million. In Series B funding, startups are usually valued at $30 million to.

There's no universal “right” time to raise a Series A. Your Series A valuation and amount raised, existing equity stake in the business, current cash runway. Well, generally speaking, the increase in the size of the next round roughly suggests an increase in valuation. · And to raise the next raise, say a B from an A. Most often it's interpreted to mean that the startup has a post-money valuation of at least $1B. Series A, it would mean the share price jumped from $3. We just pulled $75 mil in Series B and interested to know where the company stands. In fact, the median Series B startup has a pre-money valuation of $40 million. Series B funding is mostly used for scale — not development. Most venture firms. While a Series A funding round is to really get the team and product developed, a Series B Funding round is all about taking the business to the next level. Series Funding is the initial financing round that a business receives from investors other than the company's founders. These outside parties. Also, such companies generally come with solid valuations of more than $10 million. The proceeds from the series B round are primarily utilized to support the. Series B valuations have shown a strong rebound over the past two quarters. The median valuation for primary Series B rounds surged by 33% between Q3 and Q4. This is an inside look at what led to our $33 million Series B round led by Redpoint and Jack Altman. Our Series B was led by the lead investors of our seed. A series A valuation is typically lower than a series B valuation because the company is at an earlier stage of development and has less revenue and less user. Average Series B funding amount: Series B deal sizes peaked in with $46M, followed by a steep decline that hit its lowest point of $30M average in Q4 In a Series B financing round, companies have advanced their business, resulting in a higher valuation by this time. Companies can seek various ways to raise. Top Series B startups hiring now. Sort by valuation and recent funding. Research Series B startup salary and equity. Series B investors may account for this risk by asking for more equity. At the same time, business owners need to protect their equity and valuation during B-. Blockchain messaging protocol LayerZero raises $M, hitting $3B valuation · Jacquelyn Melinek. am PDT • April 4, Seed valuations often range from $ million, while Series B+ valuations can be $50 million+. Valuation negotiations with strategic investors are a key part of. These phases are commonly divided into the following rounds: Seed, Series A, Series B, and Series C (additional rounds added if valuation than an earlier. A Series B company is typically valued at $20 million or more. This valuation is based on several factors, including revenue, growth rate, profitability, and. Average Series B funding amount: Series B deal sizes peaked in with $46M, followed by a steep decline that hit its lowest point of $30M average in Q4

Etrade Pro Price

This scanner is similar to the Etrade Pro Momentum Scanner but focuses on penny stocks instead. VWAP stands for Volume Weight Average Price. VWAP is a trading. Exclusions may apply and E*TRADE reserves the right to charge variable commission rates. The standard options contract fee is $ per contract (or $ per. ETrades Fees and Pricing Review · $0 for stocks, options, and ETF's · $ options contracts or $ with 30+ trades per quarter · $ – futures contracts. $0 commissions for online US stock, ETF, and option trades. Margin rates among the most competitive in the industry—as low as %. No minimums to open an. The standard options contract fee is $ per contract (or $ per contract for clients who execute at least 30 stock, ETF, and options trades per quarter). @DayTradeMachine Etrade Pro Not working? @assailed Anybody having login problems with Etrade PRO again? cost basis?! Do you expect. E*TRADE Pro Cost. As a platform, E*TRADE Pro is free. However, there are some requirements to meet before gaining access to the software. First. Etrade Pro Tutorial | How To Trade Stocks and Options Part 2. Jason Brown You're now able to see the bids and asks for that specific strike price option. E*TRADE from Morgan Stanley offers $0 commissions for online US-listed stock, ETF, mutual fund, and options trades - other rates and fees may apply. This scanner is similar to the Etrade Pro Momentum Scanner but focuses on penny stocks instead. VWAP stands for Volume Weight Average Price. VWAP is a trading. Exclusions may apply and E*TRADE reserves the right to charge variable commission rates. The standard options contract fee is $ per contract (or $ per. ETrades Fees and Pricing Review · $0 for stocks, options, and ETF's · $ options contracts or $ with 30+ trades per quarter · $ – futures contracts. $0 commissions for online US stock, ETF, and option trades. Margin rates among the most competitive in the industry—as low as %. No minimums to open an. The standard options contract fee is $ per contract (or $ per contract for clients who execute at least 30 stock, ETF, and options trades per quarter). @DayTradeMachine Etrade Pro Not working? @assailed Anybody having login problems with Etrade PRO again? cost basis?! Do you expect. E*TRADE Pro Cost. As a platform, E*TRADE Pro is free. However, there are some requirements to meet before gaining access to the software. First. Etrade Pro Tutorial | How To Trade Stocks and Options Part 2. Jason Brown You're now able to see the bids and asks for that specific strike price option. E*TRADE from Morgan Stanley offers $0 commissions for online US-listed stock, ETF, mutual fund, and options trades - other rates and fees may apply.

There is no cost per month. It's free to use. You just need to have no less than $ in the account.

ETRADE PRO. The MetaTrader 5 MetaTrader 5 equips traders with the full arsenal of analytical tools for the most thorough price analysis and forecasting. VWAP stands for Volume Weight Average Price. VWAP is a trading benchmark used especially in pension plans. It is calculated by adding up the dollars traded. Options trades will be subject to the standard $ per-contract fee. Service charges apply for trades placed through a broker ($25) or by automated phone ($5). When using a stop-loss order, you basically instruct your broker to automatically sell some or all of your holdings of a stock if its price falls below a. Lower pricing lets you keep more cash to trade ; $0 commission trades. Online US-listed stocks, options, ETFs, mutual funds ; 50¢. Options contracts ; $ There is no cost per month. It's free to use. You just need to have no less than $ in the account. @DayTradeMachine Etrade Pro Not working? @assailed Anybody having login problems with Etrade PRO again? cost basis?! Do you expect. The Order Entry screen then pops out and is pre-populated with all of the information for the specific trade. From there, you're able to choose your price type. The E-TRADE Financial Corporation stock price today is What Is the Stock Symbol for E-TRADE Financial Corporation? The stock ticker symbol for E-TRADE. Options are commission-free, but if you make at least 30 trades per quarter, the per contract fee drops to $, from $ Normally, these fees can add up. Exclusions may apply and E*TRADE from Morgan Stanley reserves the right to charge variable commission rates. The standard options contract fee is $ per. Pros Explained · Industry-best mobile apps for investors and traders: E*TRADE's two available mobile apps offer a powerful combination that has earned this. E*TRADE Pro is a sophisticated stock trading platform designed for active traders seeking advanced tools and features to enhance their trading experience and. Pros: Competitive fees, ease of cash transfers and useful financial tools. Pros of E-Trade pro: Easy money transfer between other etrade bank accounts. $ per contract for options on TWS Lite; that is also the base rate for TWS Pro users, with scaled rates based on volume. $ per contract for futures. Pricing you can write home about · $0 commission trades · 50¢ · $ Compare Active Trader Pro and E*Trade Web Platform head-to-head across pricing, user satisfaction, and features, using data from actual users. Etrade Pro will appear on the same chart on your mobile device. If you fail Mortgage rates fall using price action to trade binary options graph. Overview · Cost per stock/ETF trade: $0 · Cost per options trade: $ per contract, or $ for more than 30 trades per quarter. Find out what's poised to drive the markets now that the Fed has greenlighted lower interest rates. forc-it.ru George Birzan and 8 others.

What Is Coca Cola Stock Symbol

Our stock is listed and traded on the New York Stock Exchange under the ticker symbol KO. How do I buy stock in The Coca-Cola Company? How do I transfer my. Financials Coca-Cola Co.(KO). Quarterly Annual. Net Income. KO | Complete Coca-Cola Co. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Coca-Cola Company (KO) · Barchart Technical Opinion · Business Summary · KO Related ETFs · KO Related stocks · Key Turning Points. COKE | Complete Coca-Cola Consolidated Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Coca Cola Stock FAQ · What is Coca Cola's quote symbol? (NYSE: KO) Coca Cola trades on the NYSE under the ticker symbol KO. · What is the 52 week high and low for. Coca-Cola Company (The) Common Stock (KO) Stock Price, Quote, News & History | Nasdaq. The stock symbol for Coca-Cola European is "CCEP." Does Coca-Cola European Pay Dividends? What's The Current Dividend Yield? The. Get Coca-Cola Co (KO:NYSE) real-time stock quotes, news, price and financial information from CNBC. Our stock is listed and traded on the New York Stock Exchange under the ticker symbol KO. How do I buy stock in The Coca-Cola Company? How do I transfer my. Financials Coca-Cola Co.(KO). Quarterly Annual. Net Income. KO | Complete Coca-Cola Co. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Coca-Cola Company (KO) · Barchart Technical Opinion · Business Summary · KO Related ETFs · KO Related stocks · Key Turning Points. COKE | Complete Coca-Cola Consolidated Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Coca Cola Stock FAQ · What is Coca Cola's quote symbol? (NYSE: KO) Coca Cola trades on the NYSE under the ticker symbol KO. · What is the 52 week high and low for. Coca-Cola Company (The) Common Stock (KO) Stock Price, Quote, News & History | Nasdaq. The stock symbol for Coca-Cola European is "CCEP." Does Coca-Cola European Pay Dividends? What's The Current Dividend Yield? The. Get Coca-Cola Co (KO:NYSE) real-time stock quotes, news, price and financial information from CNBC.

Our stock is listed and traded on the New York Stock Exchange under the ticker symbol KO.

Real time Coca-Cola (KO) stock price quote, stock graph, news & analysis. The Coca-Cola Company's stock symbol is KO and currently trades under NYSE. It's current price per share is approximately $ What are your The Coca-Cola. Historical Lookup. Symbol COKE (Common stock). Lookup Month. January, February, March, April, May, June, July, August, September, October, November, December. Coca-Cola Company trades on the NYSE stock market under the symbol KO. What is Coca-Cola Company stock price doing today? As of August 27, Coca-Cola Company (The). New York Stock Exchange: KO. Coca-Cola Co (KO) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Coca Cola Company is listed in the Beverages sector of the New York Stock Exchange with ticker KO. The last closing price for Coca Cola was $ Over the. Get live stock quote for Coca-Cola Company. An overview of KO historical prices Coca-Cola Co (KO). NYSE. Symbol. Exchange. Currency. KO, NYSE, USD, Real-time. Latest Coca-Cola Co (KO:NYQ) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and more. Coca-Cola (NASDAQ:COKE) has been a rewarding long-term investment, with our existing swing position yielding significant profits. Presently, the stock. The current price of KO is USD — it has decreased by −% in the past 24 hours. Watch Coca-Cola Company (The) stock price performance more closely on. Complete Coca-Cola Co. stock information by Barron's. View real-time KO stock price and news, along with industry-best analysis. Discover real-time Coca-Cola Consolidated, Inc. Common Stock (COKE) stock prices, quotes, historical data, news, and Insights for informed trading and. Coca-Cola (KO) has been one of the stocks most watched by forc-it.ru users lately. So, it is worth exploring what lies ahead for the stock. Zacks. Coca-Cola Co. historical stock charts and prices, analyst ratings, financials, and today's real-time KO stock price. Get a real-time The Coca-Cola Company (KO) stock price quote with breaking news, financials, statistics, charts and more. Real-time Price Updates for Coca-Cola Company (KO-N), along with buy or sell indicators, analysis, charts, historical performance, news and more. Coca-Cola Share Price Live Today:Get the Live stock price of KO Inc., and Coca-Cola. SYMBOL:KO|SECTOR:Consumer Staples|DERIVED:CFD. i. Derived prices. Historically, ticker symbols on the New York Stock Exchange were 1, 2 or 3 letters, while NASDAQ tickers were four letters (there were some. Coca-Cola shares symbol on the NYSE stock exchange is KO. Coca-Cola Stock Quote. Real-time quotes help traders to analyze and fix effective prices to trade, buy.

What Would My Loan Payment Be

Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. Use NerdWallet's free loan calculator to determine your monthly payment, your total interest and payoff schedule. How does my credit score affect my interest rate? Use our Personal Loan Payment Calculator to see what your monthly payments could be. My reason for borrowing. Select, Consolidate credit card debt. For example, if you know how much you can afford for a monthly payment over a certain number of months and you want to calculate how much money you might afford. Utilize this calculator to determine your monthly or yearly payment amount for a fixed-rate loan. How long will it take to pay off my loan? Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are. This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. Use NerdWallet's free loan calculator to determine your monthly payment, your total interest and payoff schedule. How does my credit score affect my interest rate? Use our Personal Loan Payment Calculator to see what your monthly payments could be. My reason for borrowing. Select, Consolidate credit card debt. For example, if you know how much you can afford for a monthly payment over a certain number of months and you want to calculate how much money you might afford. Utilize this calculator to determine your monthly or yearly payment amount for a fixed-rate loan. How long will it take to pay off my loan? Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are. This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much.

With the loan amount and term you already specified, add a couple more details to see lenders that might be a fit for what you need. 0 auto loans found. Filter. For example, if you know how much you can afford for a monthly payment over a certain number of months and you want to calculate how much money you might afford. You're gearing up to buy your next car but aren't sure what the monthly car payment will look like. Getting to a monthly payment usually involves some math, but. payments might be smaller as a result. Once you get approved for a personal loan, you will receive information on exactly what your monthly payment will be. Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator. What is a loan rate calculator? Capital Farm Credit provides a land payment calculator that maps out your payments and loan amount, indicating your total. If you're considering a personal loan, it can help to see what you might pay each month. Use our simple loan payment calculator to create monthly payment. Use my current location City, State or Zip. Make an Appointment. Meet with a Wells Fargo does not make loans for educational purposes. 4. Annual. Budgeting for a loan? Plug a few details into our calculator to determine the cost of your monthly payments. Get help deciding if your monthly payment will fit your budget with this loan payment calculator. Use our loan calculator to estimate your payments, total interest and principal. Learn more about your financial situation. We calculate the monthly payment, taking into account the loan amount, interest rate and loan term. The pay-down or amortization of the loans over time is. my vehicle payments be? Help. In Now, you can adjust your settings to see how different loan terms or loan amounts could impact your monthly payment. How long will it take to pay off my loan? Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. A personal loan calculator can break down how much interest you'll pay over the loan term and help you compare offers. What is a good personal loan rate? A “. SmartAsset's student loan payoff calculator shows what your monthly loan payments will look like and how your loans will amortize over time. Discover average personal loan rates, calculate what you'll save with debt consolidation, and learn how to compare options with our personal loan. Use the farm or land loan calculator to determine monthly, quarterly, semiannual or annual loan payments. Get ag-friendly, farm loan rates and terms. loan, your interest rate—and monthly payment—could rise later on. How can I lower my monthly student loan payments without extending the repayment term?

Tax Brackets For 2021 Tax Year

Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. Income Tax Brackets · $, for married individuals filing jointly and surviving spouses, · $, for single individuals and heads of households. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, Federal Income Tax Rates ; $23, - $94,, $11, - $47,, $16, - $63,, $11, - $47, ; $94, - $,, $47, - $,, $63, - $, Canada Income Tax Brackets and Marginal Tax Rate for ; 2nd Tax Bracket, $48, to $97,, $, to $, ; Tax Threshold & Rate, $6, %. CAUTION! The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Prior Years · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 11,, 10 ; 11, to 44,, 12 ; 44, to 95,, 22 ; 95, to ,, Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. Income Tax Brackets · $, for married individuals filing jointly and surviving spouses, · $, for single individuals and heads of households. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, Federal Income Tax Rates ; $23, - $94,, $11, - $47,, $16, - $63,, $11, - $47, ; $94, - $,, $47, - $,, $63, - $, Canada Income Tax Brackets and Marginal Tax Rate for ; 2nd Tax Bracket, $48, to $97,, $, to $, ; Tax Threshold & Rate, $6, %. CAUTION! The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Prior Years · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 11,, 10 ; 11, to 44,, 12 ; 44, to 95,, 22 ; 95, to ,,

For Tax Years , , and the North Carolina individual income tax rate is % (). The new rate for each tax year is as follows: For Taxable. Single filers for tax year who have less than $9, in taxable income are subject to the 10% income tax rate, which is the lowest bracket. Every dollar. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, OBRA93 delayed indexation of the new top income tax brackets for one year. forc-it.ru - Canada's & Personal income tax brackets and tax rates for for eligible and non-eligible dividends, capital gains, and other income. Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 11,, 10 ; 11, to 44,, 12 ; 44, to 95,, 22 ; 95, to ,, taxes payable from other sources of income. This assumption is consistent with prior year rates. © Ernst & Young LLP. All rights reserved. EY logo. Tax Booklet If Your Taxable. Income Is The Tax For. Filing Status. At. Least. But Not. Over. 1 Or 3. Is. 2 Or 5. Is. 4. Is. $1. $ Tax Information for Individual Income Tax. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. IA TAX TABLES For All Filing Statuses. To find your tax: Read down the left column until you find the range for your Iowa taxable income from line. Anne Arundel Co. The local tax rates for calendar year are as follows of an individual's Maryland taxable income of $1 through $50,; and. tax rate is generally less than that. First, here are the tax rates and the income ranges where they apply: Tax Year: , , , , , , For Tax Years , , and the North Carolina individual income tax rate is % (). The new rate for each tax year is as follows: For Taxable. January 1, – December 31, , % or January 1, – December 31, , 5% or Tax years prior to , Contact us for assistance. This. January 1, – December 31, , % or January 1, – December 31, , 5% or Tax years prior to , Contact us for assistance. This. Tax Chart. To identify your tax, use your Missouri taxable income from Form MO, Line 27Y and 27S and the tax chart in. Section A below. A separate. Anne Arundel Co. The local tax rates for calendar year are as follows of an individual's Maryland taxable income of $1 through $50,; and. For married couples filing jointly, the range is $, to $, Income in this bracket is taxed at a 35% rate. 37% Bracket: The highest tax bracket is Single or Married Filing Separately. Married Couple or Head of Household ; Taxable Income. Tax. Taxable Income ; $0 - $26, % of taxable income. $0 -. Federal Taxes ; 32%. $, $, ; 35%. $, $, ; 37%, $,, $, ; Source: Internal Revenue Service. Tax Brackets & Rates ; , ; 10%, 0 – $19,, 10% ; 12%, $19, – $80,, 12% ; 22%, $80, – $,, 22%.

How Do Treasury Bills Work

T-bills work differently than longer-term fixed-income investments, which pay interest semiannually until maturity. You buy T-bills at a discount from the face. A Treasury Bill is essentially a promise by the Treasury Department to pay the holder of the bill a specified amount on a certain date. Unlike other forms of. They mature in 5, 10, or 30 years. Like bonds and notes, the price and interest rate are determined at the auction. Treasury products, such as Treasury bills, notes, and bonds, are issued by the government to raise funds. They are considered a safe investment option. How do Treasury Bills work? T-Bills have zero-coupon rates, i.e. no interest is earned on a T-Bill investment. Rather T-Bills are purchased at a discount to. Treasury bills are zero-coupon securities, issued at a discount to investors. Hence, total returns generated by such instruments remain constant through the. When you buy a T-bill, you pay less than its face value and then receive the bill's face value when it matures. This represents the bill's "interest" payments. Treasury bills (T-bills) are short-term Singapore Government Securities (SGS) issued at a discount to their face value. Investors receive the full face value at. Key Takeaways · Treasury bills are debt obligations issued by the U.S. Department of the Treasury. · T-bills have the shortest maturity date of all the debt. T-bills work differently than longer-term fixed-income investments, which pay interest semiannually until maturity. You buy T-bills at a discount from the face. A Treasury Bill is essentially a promise by the Treasury Department to pay the holder of the bill a specified amount on a certain date. Unlike other forms of. They mature in 5, 10, or 30 years. Like bonds and notes, the price and interest rate are determined at the auction. Treasury products, such as Treasury bills, notes, and bonds, are issued by the government to raise funds. They are considered a safe investment option. How do Treasury Bills work? T-Bills have zero-coupon rates, i.e. no interest is earned on a T-Bill investment. Rather T-Bills are purchased at a discount to. Treasury bills are zero-coupon securities, issued at a discount to investors. Hence, total returns generated by such instruments remain constant through the. When you buy a T-bill, you pay less than its face value and then receive the bill's face value when it matures. This represents the bill's "interest" payments. Treasury bills (T-bills) are short-term Singapore Government Securities (SGS) issued at a discount to their face value. Investors receive the full face value at. Key Takeaways · Treasury bills are debt obligations issued by the U.S. Department of the Treasury. · T-bills have the shortest maturity date of all the debt.

US Treasury securities are direct debt obligations backed by the full faith and credit of the US government. Interest can be paid at maturity or semiannually. Treasury bills, also known as T-bills, allow the subscriber to earn a profit on investment by redeeming the treasury bills at face value. Treasuries are debt obligations issued and backed by the full faith and credit of the US government. Because they are considered to have low credit or default. These bills are used to raise funds to finance government projects and are considered one of the safest investment options in Nigeria. How do Treasury Bills. When an investor buys a Treasury Bill, they are lending money to the government. The US Government uses the money to fund its debt and pay ongoing expenses such. All UK Treasury bills are sterling denominated unconditional obligations of the UK Government with recourse to the National Loans Fund and the Consolidated. We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. The government issues T-Bills at discounted rate and pays the interest upfront while the investment sum is repaid at maturity. So, if you were to invest ₦. Investors buying Treasury bonds are loaning the government money for a specified period of time, which is the bond's maturity. With most bonds, investors will. Treasury bills, notes, and bonds available at auction are not listed on our website until between and pm, ET, on the Announcement date. How do T-bills work? Treasury bills are issued at a discount to original value and the buyer gets the original value upon maturity. For example, a Rs T-bills are short-term securities that mature in one year or less from their issue date. T-bills are issued with 3 month, 6 month, and 1 year maturities. Did you know that when you buy a U.S. Treasury bond, you are basically extending the U.S. government a loan? The government borrows a dollar amount from you . T-bills are issued at a discount to the face value. For example, if the cut-off yield for a 6-month T-bills with days to maturity is %, this. How do treasury bills work? Within the UK, treasury bills are typically issued on a weekly basis by tender. The timeframe will vary, but three and six-month. How a Treasury bill works. A Treasury bill, or T-bill, is a short-term debt obligation backed by the U.S. Treasury Department. It's one of the safest. Treasury Bills, also known as T-Bills, are short-term government-backed securities issued by the CBN. They are issued when the government requires a. Treasury bills currently offer yields higher than a traditional high-yield savings account.** Plus, you don't have to pay state or local taxes on the income you. A treasury bill is issued at a discounted rate and is redeemed at nominal value, ultimately allowing some profit to the subscriber. What Are Treasury Bills (T-.

Risks Of Leveraged Etfs

Another risk associated with leveraged ETFs is liquidity risk. Some leveraged ETFs may have lower trading volumes and liquidity compared to traditional ETFs. warn retail investors of the risks associated with investing in non-traditional ETFs and issued an Investor Alert entitled “Leveraged and Inverse ETFs. This clearly illustrates the advantage and dangers of leveraged ETFs: the potential to increase returns but also the high risk of losing all the capital should. First, the leverage component means that gains or losses are magnified. For instance, if an underling index declines 20%, the 3x leveraged ETF could lose 60% of. Leveraged ETFs can increase gains, but they can also increase losses compared to the underlying assets. leveraged- · and-inverse-etfs-specialized-products-extra-risks- · buy-and-hold-investors · forc-it.ru · forc-it.ru Page 4. © Extremely long and extended periods of stock declines are needed for leverage to backfire. There's definitely a risk and reward similar to. These funds only target daily performance, and after the effects of long-term leverage, fees, and transaction costs for the fund managers, these funds may. A leveraged ETF's amplified daily returns can trigger steep losses in short periods of time, and a leveraged ETF can lose most or all of its value. Shares of. Another risk associated with leveraged ETFs is liquidity risk. Some leveraged ETFs may have lower trading volumes and liquidity compared to traditional ETFs. warn retail investors of the risks associated with investing in non-traditional ETFs and issued an Investor Alert entitled “Leveraged and Inverse ETFs. This clearly illustrates the advantage and dangers of leveraged ETFs: the potential to increase returns but also the high risk of losing all the capital should. First, the leverage component means that gains or losses are magnified. For instance, if an underling index declines 20%, the 3x leveraged ETF could lose 60% of. Leveraged ETFs can increase gains, but they can also increase losses compared to the underlying assets. leveraged- · and-inverse-etfs-specialized-products-extra-risks- · buy-and-hold-investors · forc-it.ru · forc-it.ru Page 4. © Extremely long and extended periods of stock declines are needed for leverage to backfire. There's definitely a risk and reward similar to. These funds only target daily performance, and after the effects of long-term leverage, fees, and transaction costs for the fund managers, these funds may. A leveraged ETF's amplified daily returns can trigger steep losses in short periods of time, and a leveraged ETF can lose most or all of its value. Shares of.

Leveraged ETF funds actually deliver their promised daily performance, but their marketing material omits performance data for longer periods. Boilerplate risk. 3x ETFs are a unique breed of investment instruments that seek to amplify returns by a factor of three compared to the index or sector they track. Risks and Considerations of Leveraged ETFs Leveraged ETFs should not be used as long-term investments. This is because of the compounding effect of losses—. Leveraged ETFs are highly speculative investments that pose unique risks to investors. One of the primary risks associated with leveraged ETFs is the. While leveraged ETFs can offer significant upside potential, they also come with a unique set of risks, including the potential for decay. Leveraged ETF prices tend to decay over time, and triple leverage will tend to decay at a faster rate than 2x leverage. As a result, they can tend toward zero. For this reason, financial advisors do not typically recommend holding leveraged ETFs for long periods. For example, say an investor buys a share of a leveraged. leveraged ETFs use financial derivatives and debt to achieve their objective. These ETFs use futures and options contracts to achieve their desired leverage. Direxion Shares ETF Risks — An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks. Provided the underlying benchmark index follows a geometric Brownian motion, leveraged ETFs appear to cause value destruction in the long-run Cheng and. Leveraged ETFs are risky investments. The two major risks associated with leveraged ETFs are decay and high volatility. High volatility translates to high risk. Direxion Shares ETF Risks — An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks. In its guidance note, IIROC warned that leveraged and inverse ETFs that are reset daily are typically “unsuitable for retail investors who plan to hold them for. The use of leverage by an ETF increases the risk and are not suitable for all investors and should be utilized only by sophisticated investors who. Leveraged ETFs can offer the potential for higher returns but come with increased risk and complexity. They are best suited for experienced traders. However, that doesn't take away the very significant risks that do prevail, such as high volatility and tracking error, or failure to mirror the returns of the. Before investing in leveraged ETFs, it's important to understand the risks involved. These ETFs use derivatives to amplify the returns of an underlying index. Abstract. This article investigates using X leveraged stock and bond exchange-traded funds (ETFs) as an asset allocation strategy. Counterparty risk. Leveraged ETFs are riskier than traditional ETFs (non-leveraged) since they obtain leverage by using options, futures and/or swaps to. You can lose your money rapidly due to leverage. Please ensure you understand how this product works and whether you can afford to take the high risk of losing.

Auto Trading On Mt4

Here is where we can configure if we want to activate or deactivate the automatic trading for a concrete EA. Auto Trading with MT4 is one of the few ways to literally put your earned income on autopilot. You now have the opportunity to make your own MT4 autotrader. To do that, use the “Auto Trading” button in the toolbar. A single click enables/disables the automated trading for your MT4 platform. To enable EAs and to. Precision forex expert advisors (EAs) designed for auto trading in metatrader MT4. Absolutely! You can definitely automate a profitable forex trading strategy in both MT4 and MT5 using Expert Advisors (EAs). You can download a free application for MetaTrader 4 from Code Base, buy or rent one from the Market or order it via the Freelance service. MetaTrader 4 autotrade script automates trading in MT4. It executes trades based on predefined strategies, indicators, and conditions. Set parameters for entry/. Using this EA, you're able to turn off "AutoTrading" completely, and your EAs won't be able to open trades or take any other actions. AutoTrading Scheduler lets you manage AutoTrading automatically in MT4 and MT5 based on a weekly schedule. Download this free expert advisor to restrict. Here is where we can configure if we want to activate or deactivate the automatic trading for a concrete EA. Auto Trading with MT4 is one of the few ways to literally put your earned income on autopilot. You now have the opportunity to make your own MT4 autotrader. To do that, use the “Auto Trading” button in the toolbar. A single click enables/disables the automated trading for your MT4 platform. To enable EAs and to. Precision forex expert advisors (EAs) designed for auto trading in metatrader MT4. Absolutely! You can definitely automate a profitable forex trading strategy in both MT4 and MT5 using Expert Advisors (EAs). You can download a free application for MetaTrader 4 from Code Base, buy or rent one from the Market or order it via the Freelance service. MetaTrader 4 autotrade script automates trading in MT4. It executes trades based on predefined strategies, indicators, and conditions. Set parameters for entry/. Using this EA, you're able to turn off "AutoTrading" completely, and your EAs won't be able to open trades or take any other actions. AutoTrading Scheduler lets you manage AutoTrading automatically in MT4 and MT5 based on a weekly schedule. Download this free expert advisor to restrict.

MQL4 language provides a special group of trade functions designed for developing automated trading systems. Programs developed for automated trading with no. The MetaTrader 5 trading platform includes full-featured MQL5 IDE (integrated development environment) that allows to develop and run automated trading programs. Automated trading uses automation programs that execute pre-set rules to enter or exit a trade. With automated trading, you combine technical analysis with pre-. AutoTrading Scheduler lets you control the time periods when AutoTrading is enabled or disabled in your MetaTrader. You can set time periods for each of the. Allow automated trading – this option allows to enable or disable the performing of trade operations by Expert Advisors and scripts. If it is disabled, scripts. Expert Advisors (EA) are programmes or pieces of code, which when uploaded into the MetaTrader 4 and MetaTrader 5 enable you to engage in forex trading via. MetaTrader 5 is an automated trading platform for autotrading futures market. Many expert advisors, scripts, indicators in MQL5 market. FREE Meta Trader! Directly you can not auto trade with any MT4 Indicator. You need to send your Indicator(s) or your strategy to us on email [email protected] Our development. Automated trading is a type of trading that uses software programs to analyse the movements and prices of financial instruments and then automatically executes. In this article, I will show you how to create forex automated trading machine on mt4 using a relentless piece of hardware, which is dirt cheap and savvy. Fxpro has MT4, so get the code coded in MQL4 where the bot will be an mq4 or ex4 file, then all you need to do is place it in an experts folder. MetaTrader 4 (MT4) is renowned for its user-friendly interface, extensive technical analysis tools, and compatibility with a vast array of. DupliTrade is an MT4 compatible platform, which allows traders to automatically follow more experienced traders' signals and strategies in-real time. Trade Forex Options automatically based on your MetaTrader indicators, or copy the world's best traders signals in real time. The MetaTrader 5 algorithmic trading components comprise the specialized integrated development environment MQL5 IDE. This development environment covers the. Automated trading is a method of participating in financial markets by using a program that executes trades based on predetermined entry and exit conditions. At their core, automated trading systems are actually fairly simple programs designed to perform pre-programmed actions on your trading account. These actions. Automated trading uses programmed instructions for automatic execution, allowing full trade automation through specialized platforms. With the global. One of the key advantages of MetaTrader 4 is the automated trading feature, which enables trading with the help of automated trading robots (Expert Advisors). As we know MetaTrader 4 is an automated Algo trading software and it helps in making trades in different currencies with the best convertible charges so it is.

Cash Flow Statement Line Items

Net Income/Starting Line Net Income/Starting Line is the first line of a cash flow statement when a company employs the Indirect Method in the operating cash. Your balance sheet, income statement and cash flow statement are tools to check the health of your business. Master these documents, line item by line item. These line items on the cash flow report include activities related to the core business. This section calculates the cash flow from a business's provision. Some of the line items on a typical indirect method cash flow statement include any increase in accrued expenses payable, depreciation expense, decrease in. The key differences between the income and the cash flow statements lie in their treatment of working and fixed capital investment. The income statement takes a. Net Income/Starting Line Net Income/Starting Line is the first line of a cash flow statement when a company employs the Indirect Method in the operating cash. The Direct Method: Each line item in the income statement is provided as the actual cash inflow or outflow. For example, the revenue number reflects the cash. Cash Flow in a Cash Flow Statement is categorized into Cash Flow from Operations, Cash Flow from Investing and Cash Flow from Financing. The Direct Method and. Step 3: Break Down and Rearrange the Accounts · Equity · Net Income · Net Working Capital Movements · Put Together a New View of the Balance Sheet Items. Net Income/Starting Line Net Income/Starting Line is the first line of a cash flow statement when a company employs the Indirect Method in the operating cash. Your balance sheet, income statement and cash flow statement are tools to check the health of your business. Master these documents, line item by line item. These line items on the cash flow report include activities related to the core business. This section calculates the cash flow from a business's provision. Some of the line items on a typical indirect method cash flow statement include any increase in accrued expenses payable, depreciation expense, decrease in. The key differences between the income and the cash flow statements lie in their treatment of working and fixed capital investment. The income statement takes a. Net Income/Starting Line Net Income/Starting Line is the first line of a cash flow statement when a company employs the Indirect Method in the operating cash. The Direct Method: Each line item in the income statement is provided as the actual cash inflow or outflow. For example, the revenue number reflects the cash. Cash Flow in a Cash Flow Statement is categorized into Cash Flow from Operations, Cash Flow from Investing and Cash Flow from Financing. The Direct Method and. Step 3: Break Down and Rearrange the Accounts · Equity · Net Income · Net Working Capital Movements · Put Together a New View of the Balance Sheet Items.

Cash from Operating Activities = Net Income + Depreciation + Deferred Taxes + Other non-cash items + Changes in Working Capital. Cash from Investing Activities. The statement of cash flows classifies cash receipts and disbursements as operating, investing, and financing cash flows. Both inflows and outflows are. Cash flows are classified as either operating, financing or investing activities depending on their nature. But identifying the appropriate activity category. When the company purchases inventory related items, that increases the inventory balance and represents a cash outflow. The inventory balance decrease when. Link to Net Income: The cash flow statement starts with net income, which pulls from the income statement. Make Adjustments for Non-Cash Items: In most simple. In addition to the presentation of cash flows, ASC requires supplementary cash flow information, which includes disclosure of interest and income taxes paid. A cash flow statement is a financial document outlining your business's sources of cash (like revenue, sale of assets, or raising capital) and uses of cash. Components of the Cash Flow Statement and What They Tell Us · Operating Activities · Investing Activities · Financing Activities · “Bottom Line” · Supplemental. Cash is King. Profit figures are easier to manipulate because they include non-cash line items such as depreciation ex- penses or goodwill write-offs. Under. It also shows the beginning and ending cash, cash equivalents, and restricted cash. Line items in the direct cash flow statement would include cash received. Net income from the bottom of the income statement is used as the starting point · All non-cash items are “added back,” meaning any accruals are reversed. It is one of the three main financial statements, along with the income statement and balance sheet, and reflects the change in cash within an entity by. A Statement of Cash Flows (or Cash Flow Statement) shows the movement in the Cash account of a company. Accountants follow the accrual basis in measuring. A cash flow statement will report every cash inflow and outflow that arises from operating, investing and financing activities. Most items are easy to classify. Cash outflows (cash leaving the business) are negative values and are represented by values in parentheses on the statement. You'll then see line items for each. The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities, each providing valuable. A cash flow statement is a financial statement that shows the sum total of a company's cash inflows from their ongoing processes and external investments. Capital receipts (lines ) are cash inflows from the sale of capital items, such as breeding livestock, machinery, and equipment. Also, only the amount of. The SCF reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. The time interval (period of time). Cash from Operating Activities Cash From Operating Activities represents the sum of: Net Income/Starting Line Depreciation/Depletion Amortization Deferred Taxes.

1 2 3 4 5 6 7