forc-it.ru

Learn

Emx Royalty Stock Forecast

The 1 analyst with a month price forecast for EMX Royalty stock has a target of , which predicts an increase of % from the current stock price of. Monitor the latest movements within the EMX Royalty Corp real time stock price chart below. What Is the EMX Royalty Corp Stock Price Today? The EMX Royalty Corp. The average price target is C$ with a high forecast of C$ and a low forecast of C$ The average price target represents a % change from the. Analyst Forecast. According to one analyst, the rating for EMX stock is "Strong Buy" and the month stock price forecast is $ The average one-year price target for EMX Royalty Corporation is $ The forecasts range from a low of $ to a high of $ A stock's price target is. Price Target. Only one analyst offered a short-term price target of $ for EMX Royalty Corp. This represents an increase of % from the last closing. The Wall Street analyst predicted that Emx Royalty's share price could reach $ by May 14, The average Emx Royalty stock price prediction forecasts a. Analyst's Opinion · Consensus Rating. EMX Royalty has received a consensus rating of Buy. · Amount of Analyst Coverage. EMX Royalty has only been the subject of 1. View EMX Royalty Corp EMX stock quote prices, financial information, real-time forecasts, and company news from CNN. The 1 analyst with a month price forecast for EMX Royalty stock has a target of , which predicts an increase of % from the current stock price of. Monitor the latest movements within the EMX Royalty Corp real time stock price chart below. What Is the EMX Royalty Corp Stock Price Today? The EMX Royalty Corp. The average price target is C$ with a high forecast of C$ and a low forecast of C$ The average price target represents a % change from the. Analyst Forecast. According to one analyst, the rating for EMX stock is "Strong Buy" and the month stock price forecast is $ The average one-year price target for EMX Royalty Corporation is $ The forecasts range from a low of $ to a high of $ A stock's price target is. Price Target. Only one analyst offered a short-term price target of $ for EMX Royalty Corp. This represents an increase of % from the last closing. The Wall Street analyst predicted that Emx Royalty's share price could reach $ by May 14, The average Emx Royalty stock price prediction forecasts a. Analyst's Opinion · Consensus Rating. EMX Royalty has received a consensus rating of Buy. · Amount of Analyst Coverage. EMX Royalty has only been the subject of 1. View EMX Royalty Corp EMX stock quote prices, financial information, real-time forecasts, and company news from CNN.

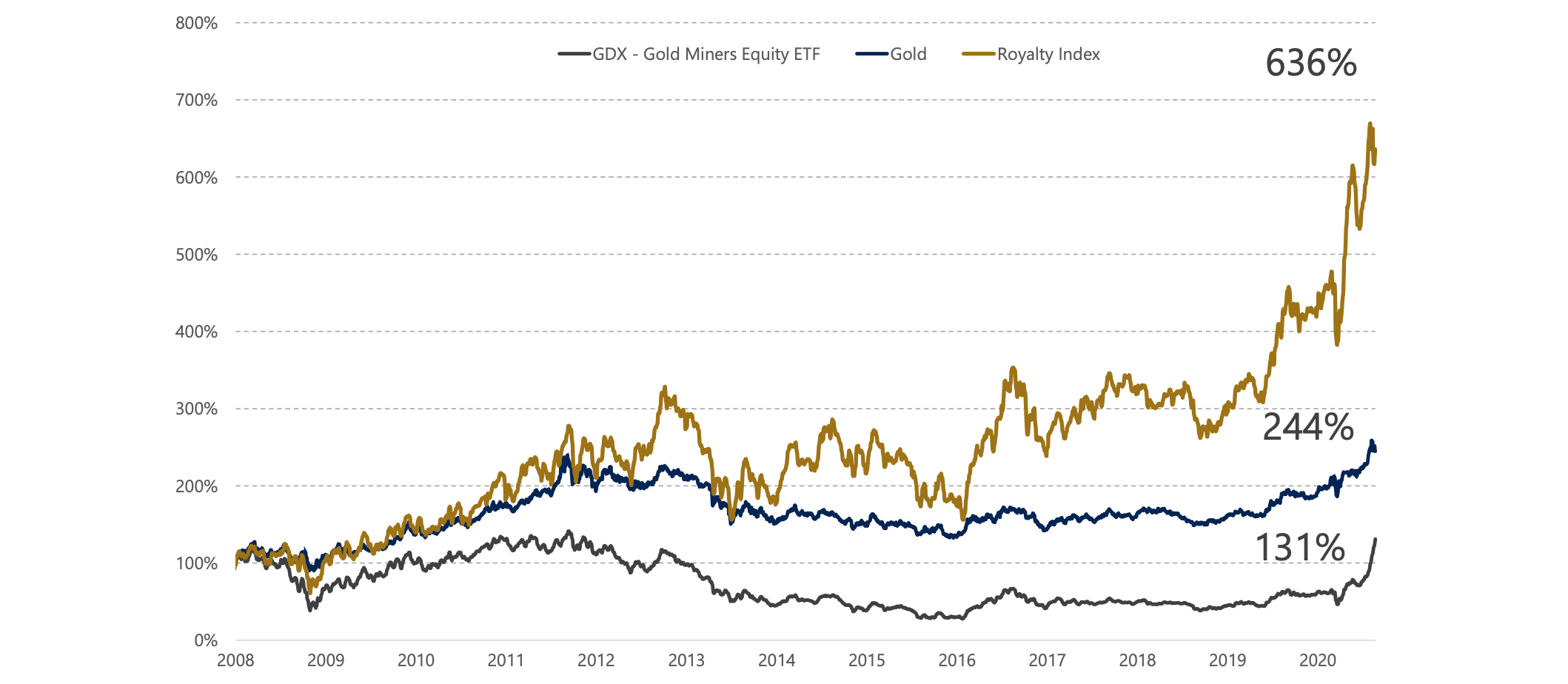

Is EMX Royalty Corporation stock A Buy? The EMX Royalty Corporation stock holds several negative signals and despite the positive trend, we believe EMX Royalty. At this time, the relative strength momentum indicator of EMX Royalty's share price is approaching 41 suggesting that the stock is in nutural position. EMX Royalty Corp and its subsidiaries operate as a royalty and prospect generator engaged in exploring for and generating royalties from, metals and minerals. (NYSEMKT: EMX) Emx Royalty stock price per share is $ today (as of Aug 2, ). What is Emx Royalty's Market Cap. EMX Royalty price target lowered to $ from $ at H.C. Wainwright. Aug. 14, at a.m. ET on forc-it.ru EMX Royalty Reports Strong Growth in Q2. What is the forecast for EMX Royalty (EMX) stock? A. EMX Royalty has a consensus price target of $ Q. Current stock price for EMX Royalty (EMX)?. A. The. EMX's current price target is $ Learn why top analysts are making this stock forecast for EMX Royalty at MarketBeat. Future price of the stock is predicted at $ (%) after a year according to our prediction system. This means that if you invested. share price growth since our inception. Here's how EMX makes money. Ongoing cash flow. Self-funded G&A. Royalties. Learn more here. Corporate Presentation. +. Wonderful prospect generator. He added today on news that EMX has reached settlement with Chinese company on Serbian royalties. Substantial free cashflow in. We've gathered analysts' opinions on EMX ROYALTY CORPORATION future price: according to them, EMX price has a max estimate of CAD and a min estimate of. EMX is currently trading in the % percentile range relative to its historical Stock Score levels. Will EMX Royalty Stock Go Up Next Year? Data Unavailable. EMX to ~$EMX, a tiny new gold royalty company should be on its way to $ Triggering the final d-target of the hourly chart would also set off the an. EMX Stock Forecast is based on your current time horizon. Investors can use this forecasting interface to forecast EMX Royalty stock prices and determine the. According to one analyst, the rating for EMX stock is "Strong Buy" and the month stock price forecast is $ EMX Royalty Grants Incentive Stock Options. Get the latest EMX Royalty (EMX) stock forecast for tomorrow and next week. Stay ahead of the game with our EMX Royalty stock price prediction for and. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. Find the latest EMX Royalty Corp (EMX) stock forecast, month price target, predictions and analyst recommendations. EMX Royalty Stock Forecast, EMX stock price prediction. Price target in 14 days: USD. The best long-term & short-term EMX Royalty share price. EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the "Company" or "EMX") is pleased to announce that it has completed the closing.

Change Credit Card To 0 Interest

Moving your high-interest credit card debt to a balance transfer card with a 0% introductory rate can save you hundreds, or even thousands, of dollars in. Enjoy 0% intro APR on balance transfers for the first 18 billing cycles after account opening with a TD FlexPay Credit Card. Unlock the features of your new. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. Once you've transferred your balance, you can capitalize on the lengthy 0% interest period. And you don't have to do anything crazy — just keep making the. Pay less interest each month on what you currently owe – most balance transfers offer a lower interest rate (often 0%) for an introductory period. Some credit. You may get a 0% APR, but it won't last forever. You need to be disciplined about your debt payoff plan in order to avoid interest charges. Otherwise, you'll. A balance transfer credit card lets you move your existing credit card balances to a new card with a lower or 0% interest rate. Most balance transfer cards offer a 0% introductory APR on balance transfers for a set amount of time, and typically on purchases as well. Credit card companies. After securing a month 0% balance transfer on a new credit card and moving the $5, balance, the cardholder gets a year to pay it off with no interest and. Moving your high-interest credit card debt to a balance transfer card with a 0% introductory rate can save you hundreds, or even thousands, of dollars in. Enjoy 0% intro APR on balance transfers for the first 18 billing cycles after account opening with a TD FlexPay Credit Card. Unlock the features of your new. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. Once you've transferred your balance, you can capitalize on the lengthy 0% interest period. And you don't have to do anything crazy — just keep making the. Pay less interest each month on what you currently owe – most balance transfers offer a lower interest rate (often 0%) for an introductory period. Some credit. You may get a 0% APR, but it won't last forever. You need to be disciplined about your debt payoff plan in order to avoid interest charges. Otherwise, you'll. A balance transfer credit card lets you move your existing credit card balances to a new card with a lower or 0% interest rate. Most balance transfer cards offer a 0% introductory APR on balance transfers for a set amount of time, and typically on purchases as well. Credit card companies. After securing a month 0% balance transfer on a new credit card and moving the $5, balance, the cardholder gets a year to pay it off with no interest and.

Most balance transfer cards offer a 0% introductory APR on balance transfers for a set amount of time, and typically on purchases as well. Credit card companies. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. The best debt consolidation credit card is the Citi Simplicity® Card because it offers an intro APR of 0% for 21 months on balance transfers, along with a $0. To avoid the transfer fee that is associated with the card, I would get the new 0% card with a month or two of 0% interest left on the old card. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. If you transfer a balance from a high-interest credit card to a Discover Card with an introductory 0% APR balance transfer offer, you can use the money you save. Most balance transfer cards offer a 0% introductory APR period of 12 to 21 months, during which your entire payment goes toward the principal balance. Here are. 0% interest on balance transfers for up to 28 months. From the date you open your account. Transfers must be made within 60 days to benefit from the 0% offer. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. Balance transfer credit cards offer interest-free periods, often 12 to 20 months, that you can use to pay off high-interest credit card debt faster than. By completing a balance transfer, you'll end up paying less interest each month or no interest at all, depending on if your card comes with an introductory 0%. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money. FYI: don't use the card for additional purchases until the zero interest offer expires or the balance is paid off. It's very easy to. Get the best offer on the market, An Post Money offers a 0% balance transfer credit card when you move your existing card balance. See benefits & apply now! FYI: don't use the card for additional purchases until the zero interest offer expires or the balance is paid off. It's very easy to. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. Finding the best 0% intro APR credit card for your financial needs will help you save money on interest. 0% intro APR cards help you avoid interest on.

Tax Cuts 2022

The Inflation Reduction Act of empowers Americans to make homes and buildings more energy-efficient by providing federal tax credits and deductions. Credits: Credit against Pennsylvania income tax is allowed for gross or net income taxes paid by Pennsylvania residents to other states. Credit is available to. At least 10 states have enacted Income tax rate cuts. Several states, including Kentucky, Georgia, Iowa, South Carolina and Virginia enacted tax reductions. Business Income Tax · Individual Income Tax · Inheritance Tax · Property Tax · Sales, Use & Excise Tax · Tax Credits, Deductions & Exemption · Withholding Tax. We'll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as it becomes available. Thanks to laws supported by Senate Republicans in and , Indiana is in the middle of a staggered individual income-tax cut that will save Hoosiers. Inflation Reduction Act changed a wide range of tax laws and provided funds to improve our services and technology to make tax filing faster and easier. The Tax Cuts and Jobs Act took effect on Jan. · The nearly page Act extensively changes the tax code for institutions and American citizens with a focus on. The Tax Cut and Jobs Act (TCJA) reduced statutory tax rates at almost all levels of taxable income and shifted the thresholds for several income tax brackets . The Inflation Reduction Act of empowers Americans to make homes and buildings more energy-efficient by providing federal tax credits and deductions. Credits: Credit against Pennsylvania income tax is allowed for gross or net income taxes paid by Pennsylvania residents to other states. Credit is available to. At least 10 states have enacted Income tax rate cuts. Several states, including Kentucky, Georgia, Iowa, South Carolina and Virginia enacted tax reductions. Business Income Tax · Individual Income Tax · Inheritance Tax · Property Tax · Sales, Use & Excise Tax · Tax Credits, Deductions & Exemption · Withholding Tax. We'll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as it becomes available. Thanks to laws supported by Senate Republicans in and , Indiana is in the middle of a staggered individual income-tax cut that will save Hoosiers. Inflation Reduction Act changed a wide range of tax laws and provided funds to improve our services and technology to make tax filing faster and easier. The Tax Cuts and Jobs Act took effect on Jan. · The nearly page Act extensively changes the tax code for institutions and American citizens with a focus on. The Tax Cut and Jobs Act (TCJA) reduced statutory tax rates at almost all levels of taxable income and shifted the thresholds for several income tax brackets .

An act to amend the Code of Laws of South Carolina, , so as to enact the Comprehensive Tax Cut Act of Extending the cuts have caused economists across the political spectrum to worry it would boost inflationary pressures and worsen America's 'dire' fiscal. The Ohio Schedule of Adjustments contains additions and deductions that must be made to federal adjusted gross income to calculate Ohio adjusted gross income. Property taxes accounted for slightly over half of the total tax revenue (PDF) for local and state government in and slightly under half in (Exhibit 1). Key Takeaways · The Tax Cuts and Jobs Act (TCJA) was the largest tax code overhaul in three decades. · The law created a single flat corporate tax rate of 21%. TaxAct has the latest tax law changes for tax returns including child tax credits, tax brackets, standard deduction changes, and more. tax rates for distilled spirits (effective January ); Changes to the : The Tax Cuts and Jobs Act made extensive changes to the Internal Revenue. Currently, the law provides for a gradual reduction in the first-year depreciation for property placed in service after before being eliminated altogether. Oregon tax credits including personal exemption credit, earned income tax Starting with tax year , if you couldn't claim the federal EITC only. The Infrastructure Investment and Jobs Act separately renewed certain excise taxes that became effective on July 1, Revenues from this excise tax. Until the AMT exemption enacted by the Tax Cuts and Jobs Act expires in tax exemption, increases to $17, per recipient (up $1, from ). Starting in , the adjustment for amortization and depreciation was removed from the limitation, making the cap more restrictive. Businesses with gross. Effective July 1, Sec. 13, Effective Dates: Secs. 1–8 (income tax credits, deductions, and exclusions) take effect retroactively on January 1, Beginning in , senior citizens are eligible for a new tax credit, among other benefits they can take advantage of. We have created a convenient tax tip. The maximum deduction in tax year is $ million and the spending cap for purchases is $ million. Deduction. Click to view the full-size. In , Governor Reynolds and the Iowa Legislature took a bold but prudent step to further reform taxes by enacting a % income tax rate for all—flat and. For taxpayers who do not itemized deductions on their Arizona income tax For taxable years beginning from and after December 31, , a tax credit. Revenue Code as of December 31, , except as otherwise provided. They'll ask questions to figure things like the total income, tax deductions, and credits. Individuals are now subject to lower tax rates on their income beginning in the tax year. These rate changes do not affect your personal income tax. Now, within months of passing tax cuts that when fully phased in will cost hundreds of millions of dollars,1 lawmakers are proposing a new round of income tax.

Client Referral Tracking Sheet

Here is your free download Referral / Prospect Tracking Spreadsheet. Modify this excel spreadsheet sample to help you keep track of all your revenue. Simple yet powerful Notion CRM. Capture leads, track referrals, create proposals: win clients. | Discover new ways to use Notion across work and life. Check out our referral tracking selection for the very best in unique or custom, handmade pieces from our templates shops. Patient Tracking worksheet (the second sheet in the Patient Tracking Spreadsheet Template). It should include notes about referral to specialty services. Matt knows how to track referrals and referrers from the home page, the client page, dashboards, and reports. Now he's ready to make intelligent need-based. Click here and download the Client Referral Tracker Sheet graphic · Window, Mac, Linux · Last updated · Commercial licence included. Who Referred Them? Contacted Referral? Y/N, Called Referral? Date, Called Referral 2nd time? Date, Called Referral 3rd time? Date, Emailed Referral? referral program to your customers, deep referral tracking, and rewards. Say goodbye to your old referral tracking sheet, and list of referral coupon. 1. Using Google Analytics · 2. Collecting information via website forms · 3. Asking the customer. · 4. Referral tracking software. · 5. Coupon codes. · 6. UTM. Here is your free download Referral / Prospect Tracking Spreadsheet. Modify this excel spreadsheet sample to help you keep track of all your revenue. Simple yet powerful Notion CRM. Capture leads, track referrals, create proposals: win clients. | Discover new ways to use Notion across work and life. Check out our referral tracking selection for the very best in unique or custom, handmade pieces from our templates shops. Patient Tracking worksheet (the second sheet in the Patient Tracking Spreadsheet Template). It should include notes about referral to specialty services. Matt knows how to track referrals and referrers from the home page, the client page, dashboards, and reports. Now he's ready to make intelligent need-based. Click here and download the Client Referral Tracker Sheet graphic · Window, Mac, Linux · Last updated · Commercial licence included. Who Referred Them? Contacted Referral? Y/N, Called Referral? Date, Called Referral 2nd time? Date, Called Referral 3rd time? Date, Emailed Referral? referral program to your customers, deep referral tracking, and rewards. Say goodbye to your old referral tracking sheet, and list of referral coupon. 1. Using Google Analytics · 2. Collecting information via website forms · 3. Asking the customer. · 4. Referral tracking software. · 5. Coupon codes. · 6. UTM.

Referral forms can help you track referrals, provide incentives, and build strong relationships with customers. By using a referral form, you can make it. Keeping track of your referrals is a breeze with these free printable referral tracker sheets! Whether you're managing a referral program, tracking client. care. 2. 3. 4. 5. 6. 7. 8. Referral Template. Example Referral. Creating and Tracking Client-Centered Referrals. Gathering and Using Client Feedback to Improve. The referral report can be handy when looking to track how your patients are Customizable Patient Sign Up Form · Creating a Group · Groups and Group. Referral tracking is the process of monitoring and keeping track of your referral campaign's results. In this article, we discuss the benefits of tracking clients in Excel, review how to track clients, provide two client-tracking Excel templates and offer two. So in its most basic form, your new client tracking system is basically Referral Program · Press · Jobs · Blog · Podcast · [email protected] Questions. Built in referral tracking (which comes with all templates on Referral Factory). The headline of your referral program template is the first thing customers see. patient volumes demand more sophisticated methods than a simple Excel spreadsheet or patient log. Contemporary patient referral tracking systems must. To create a successful referral program, most businesses will use marketing software and tools—like lead generation software—to track a customer's shared. Track employee referrals online with our free Employee Referral Tracker spreadsheet. Great for HR departments. Manage referrals seamlessly on any device. referral tracking template. What are the benefits of using this template Customer stories · Become a partner · Sustainability & ESG · Affiliates. Referral Tracker Pro helps optimize your facility's referral tracking, ensuring quick, accurate patient matching and enhanced care coordination. Client Information, For LPHA Referrals, For non-LPHA Referrals, Referrals Tracking. 5, Person/ID number, Date of birth, Language spoken, Best way to contact. Referral forms can help you track referrals, provide incentives, and build strong relationships with customers. By using a referral form, you can make it. This is a PDF Referral log printable file. Client Referral Tracker, Printable Referral Log, Referral Tracking, Referrals Worksheet, Referral Sheet, Referral. Referral Tracking: Why is it so important track it) and customers don't get a reward for their efforts. Poorly Structured Referral Program: Excel Sheet. How to promote your referral program for greatest success; How to track and measure your success; Templates and scripts cheat sheet; Tracking methods cheat. Keeping track of your referrals is a breeze with these free printable referral tracker sheets! Whether you're managing a referral program, tracking client. Maximize your business growth with our AI-powered Client Referral Tracker Generator. Streamline tracking, amplify your referrals, and enhance client.

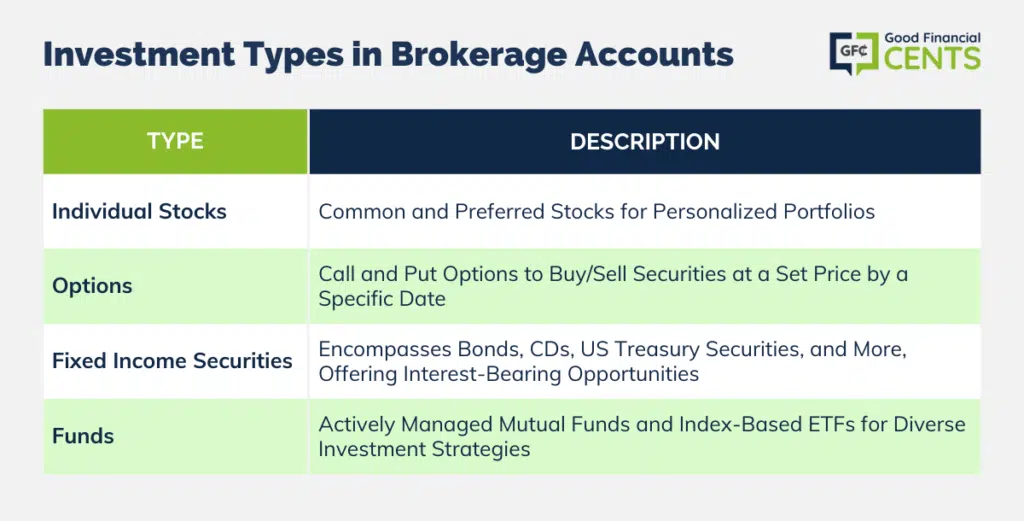

Brokerage Account That Allow Partial Shares

In order to buy fractional shares, you will need to open an investment account through either an online broker or a robo-advisor. After your account has been funded, search for the US shares or ETFs you like · Check the fractional shares icon at the right side of the stock page. S&P Own a slice of your favorite companies using dollar based investing. Buying fractional shares has never been easier. Discover how it works here. Of interest to beginning investors, using a brokerage account through SoFi allows you to participate in fractional share investing, called “stock bits” by SoFi. Fractional shares are fractions of a whole share, meaning that you don't need to buy a whole share to own a portion of a company. Invest in fractional shares with Webull. Start small by buying portions of stocks and ETFs without committing to a full share. Fractional shares trading lets you buy portions of a stock or ETF for any amount from $5, so you can own a fraction of a company for less than its stock price. Fractional shares make it possible to own part of a stock from your favorite companies and Exchange-Traded Funds (ETFs) without committing to a whole share. With fractional shares you can divide your investments among more stocks to achieve a more diversified portfolio, and put small cash balances to work quickly. In order to buy fractional shares, you will need to open an investment account through either an online broker or a robo-advisor. After your account has been funded, search for the US shares or ETFs you like · Check the fractional shares icon at the right side of the stock page. S&P Own a slice of your favorite companies using dollar based investing. Buying fractional shares has never been easier. Discover how it works here. Of interest to beginning investors, using a brokerage account through SoFi allows you to participate in fractional share investing, called “stock bits” by SoFi. Fractional shares are fractions of a whole share, meaning that you don't need to buy a whole share to own a portion of a company. Invest in fractional shares with Webull. Start small by buying portions of stocks and ETFs without committing to a full share. Fractional shares trading lets you buy portions of a stock or ETF for any amount from $5, so you can own a fraction of a company for less than its stock price. Fractional shares make it possible to own part of a stock from your favorite companies and Exchange-Traded Funds (ETFs) without committing to a whole share. With fractional shares you can divide your investments among more stocks to achieve a more diversified portfolio, and put small cash balances to work quickly.

This can enable investors to manage their investment strategies and allocations Brokerage accounts with Moomoo Financial Inc. are protected by the. Fractional shares are not transferable. If you close your account or transfer your account to another firm, the fractional share will need to be liquidated. If you already have a brokerage account with us, you can enter the ETF trade You must buy and sell Vanguard ETF Shares through Vanguard Brokerage. Fractional share market-on-close orders. All securities are offered to self-directed investors by Stockpile Investments, Inc., registered broker-dealer and. All mutual funds support fractional shares. You should be able to find equivalent mutual funds on Schwab. Some mutual funds do have minimums. Public Investing only accepts market orders for Fractional Shares and does not permit Fractional Shares within your Public Investing brokerage account are. Brokerage accounts on the M1 platform are either fully disclosed to APEX Clearing or cleared through M1 Finance LLC. Please look at your account statement to. A simple, low-cost way to invest in US stocks As implied, fractional shares allow you to buy a fraction of a share. They are yet another way to diversify your. Did you know you don't have to buy full shares of stock? It's true. Some brokerage services will allow you to buy fractional shares in some of your favorite. trading platform for stocks, ETFs, mutual funds, and more. 1. Open your shares or partial shares as possible. Which securities can I buy with Stock. Trade any US Stocks and ETFs with $0 commissions and no account fees or minimums to open a retail brokerage account. · Investing made easier with fractional. Fractional shares allow IBKR clients to divide their investments among more stocks AccountSM are service marks and/or trademarks of Interactive Brokers LLC. With fractional shares, you can invest in certain stocks and ETFs that cost hundreds or thousands of dollars for a single share with as little as $1. This gives. Brokers where you can trade fractional shares allow you to buy just a tiny fraction of an otherwise expensive stock - sometimes as small as $1. It's easy to get started investing in fractional shares. · 1. Sign up for Stash. · 2. Choose your first investment. · 3. And you're set! Alternative Assets purchased on the Public platform are not held in a Public Investing brokerage account and are self-custodied by the purchaser. The issuers of. You decide how much you're willing to invest, and a participating brokerage allows you to buy or sell pieces of a full share proportionate to that dollar amount. Additionally, we support the accumulation, transfer, and sale of fractional shares. Fractional shares accumulate via dividends, Dividend Reinvestment Plans . TIAA's fractional share trading functionality allows you to buy and sell fractional If your account is closed, your fractional shares may be liquidated, and. A simple, low-cost way to invest in US stocks As implied, fractional shares allow you to buy a fraction of a share. They are a great way to diversify your.

What Credit Model Does Mortgage Lenders Use

FICO® Scores and home loans. Most mortgage lenders will use your FICO® Scores to determine whether to approve you for a home loan and how much you can borrow. These organizations gather actual data from lenders and, using the FICO model, generate the credit score, though each of them may, and do, use different data . Most mortgage lenders use the FICO Credit Scores 2, 4, or 5 when assessing applicants. Mortgage lenders who offer conventional mortgages are required to use a. There are other credit scoring models but FICO is the industry standard, used in 90% of lending decisions in the U.S. There's also more than one FICO score. Lenders use credit scores to determine a borrower's level of risk. Three credit bureaus — Equifax, Experian, and TransUnion — calculate an individual's credit. Lenders, such as banks and credit card companies, use credit scores to evaluate the risk of lending money to consumers. Lenders contend that widespread use of. You have three FICO® scores, one for each of the three credit bureaus – Experian, TransUnion and Equifax. Each score is based on information the credit bureau. For example, you may apply for an auto loan with one lender that checks your FICO Auto Score 8 based on your Experian credit report. Yet, if you apply for. The most commonly used FICO scoring model is the FICO Score 8. This works great for most industries, but mortgage lenders prefer using much older versions. FICO® Scores and home loans. Most mortgage lenders will use your FICO® Scores to determine whether to approve you for a home loan and how much you can borrow. These organizations gather actual data from lenders and, using the FICO model, generate the credit score, though each of them may, and do, use different data . Most mortgage lenders use the FICO Credit Scores 2, 4, or 5 when assessing applicants. Mortgage lenders who offer conventional mortgages are required to use a. There are other credit scoring models but FICO is the industry standard, used in 90% of lending decisions in the U.S. There's also more than one FICO score. Lenders use credit scores to determine a borrower's level of risk. Three credit bureaus — Equifax, Experian, and TransUnion — calculate an individual's credit. Lenders, such as banks and credit card companies, use credit scores to evaluate the risk of lending money to consumers. Lenders contend that widespread use of. You have three FICO® scores, one for each of the three credit bureaus – Experian, TransUnion and Equifax. Each score is based on information the credit bureau. For example, you may apply for an auto loan with one lender that checks your FICO Auto Score 8 based on your Experian credit report. Yet, if you apply for. The most commonly used FICO scoring model is the FICO Score 8. This works great for most industries, but mortgage lenders prefer using much older versions.

There are different types of mortgage credit scoring methods, but all credit scoring systems attempt to forecast loan performance; manage credit risk; predict. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. We're going to take at look at FICO® since it has long been the auto. For the past 20 years or so, Fannie Mae and Freddie Mac have required lenders to use the "Classic FICO" credit score when evaluating borrowers' credit for a. If and when lenders do begin to use the FICO 10 model to evaluate mortgage applicants, potential homebuyers will need to take extra steps to prevent late. On October 24, , FHFA announced the validation and approval of two new credit score models, FICO 10T and VantageScore , for use by the Enterprises. Once. More than 3, institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages. There are different types of mortgage credit scoring methods, but all credit scoring systems attempt to forecast loan performance; manage credit risk; predict. When mortgage lenders review your credit history, it's likely they'll use a credit reporting agencies or even using their own in-house scoring model. Which FICO score do mortgage lenders use? · FICO Score 2 (Experian) · FICO Score 4 (TransUnion) · FICO Score 5 (Equifax). Take the next step toward financial health What You Need to Know: The credit scores provided are based on the VantageScore® model. Lenders use a variety. Most mortgage lenders use the same 3 FICO scores: Equifax Beacon , TransUnion Classic 04, and for Experian, FICO Version 2. Fannie Mae tests and validates required credit score models for accuracy, reliability, and integrity. FHFA announces publication of VantageScore historical. Are mortgage credit scores different? · Mortgage lenders use FICO scores just like other finance companies · But they pull one version from each of the three. That's because Credit Karma uses a different scoring model—VantageScore. However, most mortgage lenders, including Atlantic Bay, use FICO®, so that's the one. Experian®/Fair Isaac Risk Model V2SM; and. TransUnion FICO® Risk Score, Classic The lender must request these FICO credit scores for each borrower from each. About 90% of lenders use FICO's model to evaluate candidates for credit. Applying for a credit card, a mortgage, or an auto loan is fine. But if you. FICO Score and VantageScore are the most widely used credit scores by lenders, but they aren't the only ones. Some lenders use custom scoring models created by. Creditors use credit scoring systems to figure out if you'd be a good risk for credit cards, auto loans, and mortgages. Phone companies and companies. Recently, the Federal Housing Finance Agency (FHFA) approved the use of VantageScore for lenders who sell loans to Fannie Mae or Freddie Mac (Government. Yes, your FICO score is a credit score — but you can technically obtain credit reports elsewhere. FICO just means it's developed by the Fair Isaac Corporation .

Best Hfx Strategy

This comprehensive guide is your resource. Uncover the mechanics of day trading, swing trading, and other strategic approaches. One of the best forex indicators for any strategy is moving average. Moving averages make it easier for traders to locate trading opportunities in the direction. High frequency forex trading is a very popular trading strategy for day traders. In fact, there has been an increase in software, algorithms, and trading. To better appreciate how the 9/30 trading strategy works, let's take a look at a moving average crossover system to see how they are different. What is a moving. Below is a step by step guide to placing a binary trade: Choose a broker – Use our broker reviews and comparison tools to find the best binary trading site for. Apply some of the Examples, Common Mistakes, and Strategy Tips while entering into each day trading trade to better your odds of winning BIG. Log book investing. Here you can converse about trading ideas, strategies, trading psychology, and nearly everything in between! We also have one of the. HFX trading, or High-Frequency Forex trading, is revolutionising the financial markets. This advanced trading method harnesses sophisticated algorithms and. Apply some of the Examples, Common Mistakes, and Strategy Tips while entering into each day trading trade to better your odds of winning BIG. Log book investing. This comprehensive guide is your resource. Uncover the mechanics of day trading, swing trading, and other strategic approaches. One of the best forex indicators for any strategy is moving average. Moving averages make it easier for traders to locate trading opportunities in the direction. High frequency forex trading is a very popular trading strategy for day traders. In fact, there has been an increase in software, algorithms, and trading. To better appreciate how the 9/30 trading strategy works, let's take a look at a moving average crossover system to see how they are different. What is a moving. Below is a step by step guide to placing a binary trade: Choose a broker – Use our broker reviews and comparison tools to find the best binary trading site for. Apply some of the Examples, Common Mistakes, and Strategy Tips while entering into each day trading trade to better your odds of winning BIG. Log book investing. Here you can converse about trading ideas, strategies, trading psychology, and nearly everything in between! We also have one of the. HFX trading, or High-Frequency Forex trading, is revolutionising the financial markets. This advanced trading method harnesses sophisticated algorithms and. Apply some of the Examples, Common Mistakes, and Strategy Tips while entering into each day trading trade to better your odds of winning BIG. Log book investing.

Aside from the actual profit and loss of each strategy, we included total pips gained/lost and the max drawdown. Again, let us just remind you that we DO NOT. Why am I still losing in Forex? What can I do to refine my strategy, and cut my losses? I feel like I am extremely close to being profitable. Trading Journal is very important for Traders. It helps Traders to find an edge or improve their trading performance. Trading Journal Book App helps you to. Aside from the actual profit and loss of each strategy, we included total pips gained/lost and the max drawdown. Again, let us just remind you that we DO NOT. In a nutshell, if you know that an asset price is going to move, try to buy or sell options that are at the theoretical maximum that it could increase or drop. As a result, HFT has a potential Sharpe ratio (a measure of reward to risk) tens of times higher than traditional buy-and-hold strategies. High-frequency. strategies like scalping or day trading. The European-North American Overlap: AM to AM. This overlap is arguable the best time to trade forex. Hire a broker · Find a website best suited to you. · Read stock tables and quotes. · Know when to buy and sell. good strategy highly recommend them Show full review Hide full review Best trading platform ever and best team and community thanks pocket option. This indicator is based on Evan Cabral's Market Timing Strategy. In Binary Option or High Frequency Forex (HFX), it's very common to see the market make. Another highly-effective Forex trading strategy for beginners is the inside bar strategy. Unlike the pin bar, the inside bar is best traded as a continuation. with my strategy is that after every three to five days. of the market going in one direction, can definitely 80%, 90% of the time. expect market to be fast. As a result, HFT has a potential Sharpe ratio (a measure of reward to risk) tens of times higher than traditional buy-and-hold strategies. High-frequency. Build a stronger trading strategy with our range powerful tools. Choose from our standard or premium forex pricing modules - whatever's best for, your forex. CHOOSE. FOLLOW. MONITOR. · Copy diverse trading strategies · Learn from other traders · Gain when they gain. When starting out as an HFX trader or a forex trader in general, it is important to research properly before delving in. Having a good knowledge of the. Practice makes perfect. Trade forex in a simulated environment before trading with real money to fine-tune your strategies and gain confidence for the live. Supercharge your trading strategy. Unlock Love everything they have to offer for my trading needs and indicators, truly some of the best in the world. best-kept secrets and strategies, meticulously crafted to optimize your trading performance. Whether you're taking your initial steps in the trading world. Discover the top habits of successful forex traders and incorporate them into your own trading strategy. Learn helpful tips for the forex market here.

How To Compute Earned Income Credit

Earned Income Tax Credit Calculator | Find out how much you could get back | California Franchise Tax Board. To calculate the Iowa Earned Income Tax Credit, multiply your federal EITC by 15% ). To find out if you qualify for federal EITC, see the IRS EITC. Use the EITC Assistant to see if you're eligible for this valuable credit, calculate how much money you may get and find answers to questions. The EITC stays at its maximum value as a household's earned income continues to increase, until earnings reach a phaseout threshold, above which the credit. Use this calculator see if you qualify for the Earned Income Credit, and if so, how much it might be worth to you and your family. The credit is calculated based on your total earned income or your total Adjusted Gross Income (AGI), whichever is higher. Here is a high level overview on how. The EITC is a tax benefit for working people who earn lower or moderate incomes. The credit offsets taxes, supplements very low wages, and encourages work. This means that a qualifying claimant will receive the full benefit of the credit regardless of the net tax computed on their return, including those whose. To give you an idea of how much, the max Earned Income Credit amounts are worth up to $7, (for ) and $7, (for ), depending on your filing status. Earned Income Tax Credit Calculator | Find out how much you could get back | California Franchise Tax Board. To calculate the Iowa Earned Income Tax Credit, multiply your federal EITC by 15% ). To find out if you qualify for federal EITC, see the IRS EITC. Use the EITC Assistant to see if you're eligible for this valuable credit, calculate how much money you may get and find answers to questions. The EITC stays at its maximum value as a household's earned income continues to increase, until earnings reach a phaseout threshold, above which the credit. Use this calculator see if you qualify for the Earned Income Credit, and if so, how much it might be worth to you and your family. The credit is calculated based on your total earned income or your total Adjusted Gross Income (AGI), whichever is higher. Here is a high level overview on how. The EITC is a tax benefit for working people who earn lower or moderate incomes. The credit offsets taxes, supplements very low wages, and encourages work. This means that a qualifying claimant will receive the full benefit of the credit regardless of the net tax computed on their return, including those whose. To give you an idea of how much, the max Earned Income Credit amounts are worth up to $7, (for ) and $7, (for ), depending on your filing status.

If your income in is less than your income, you can use your earned income to calculate your EITC. Choose the year that gives you the bigger. Federal EITC requires filing of your federal return (form EZ, or A and Schedule Earned Income Credit). You can also file amended returns for three. Thereafter, it declines with each additional dollar of income until no credit is available (figure 1). In , the maximum credit for families with one. The calculator below will help determine if you qualify to claim it. Do you, your spouse (if married), and all qualifying children have a valid SSN? Yes. No. The Earned Income Credit or EIC is automatically calculated by the program and many factors contribute to how it is calculated. Use the EITC tables to look up maximum credit amounts by tax year. If you are unsure if you can claim the EITC, use the EITC Qualification Assistant. Your eligible credit amount depends on several factors – including your income, filing status, number of “qualifying children”, and/or if you are disabled. The. Earned income is your total earnings after deducting taxes you've already paid, applying credits such as the EIC and other deductions. Earned income that might. Qualifying for the EIC ; Wages, salary, or tips; Gig economy work, like rideshares; Money made from self-employment ; Interest and dividends; Pensions or. The Earned Income Tax Credit is a federal and state tax credit for people making up to $ a year and can give families up to $ back when they file. Earned Income Tax Credit calculator instructions. Step 1: Select your tax year. Step 2: Select your tax filing status. Step 3: Enter your income. TaxAct® will automatically calculate the earned income credit based on the information entered in your return. If you qualify for the credit. Use the Earned Income Tax Credit calculator from the IRS to see if you qualify for the EITC. Find additional assistance from the experts at H&R Block. Clergy · Other Church Employees · Nontaxable Pay · Additional Federal Income Schedules · Credit Calculation · Qualifying Children · Certain Filers Under Age See Explanation: §32, Earned Income Credit. The amount of the earned income tax credit (EITC or EIC) is the taxpayer's earned income up to a designated level . The Earned Income Tax Credit (EITC) is a tax credit for qualifying workers with low to moderate income. Determine your eligibility for this benefit. EIC - Using Prior-Year Earned Income to Compute Credit (Drake21) Can I use prior year earned income to calculate the Earned Income Credit for ? To get the EITC, workers must file a tax return and claim the credit, even if their earnings were below the filing requirement. Free tax preparation help is. The Illinois Earned Income Tax Credit (EITC) is a benefit for working people with low to moderate income that reduces the amount of tax owed and may result. Virginians with lower income may qualify for one of several income-based tax credits: Virginia Earned Income Tax Credit (Refundable) Credit for Low Income.

Sweetgreen Investor Relations

Sweetgreen, founded in and headquartered in Culver City, California, is a limited-service fast-food chain. Discover more about Sweetgreen. Sweetgreen worked with PwC to implement Oracle Cloud ERP and Coupa, which helped transform its financial and procurement processes to strengthen internal. The sweetgreen app for iOS and Android is the #1 most convenient way to get fresh, craveable, feel-good food on demand. About Us. Careers · Investor Relations · Locations · Press · sweetgreen app · Covid safety. Social Media. Instagram · Twitter · TikTok · Spotify · Facebook. Read press and news articles featuring sweetgreen to learn the latest about the brand. sweetgreen Contact, Investor Relations: Rebecca Nounou [email protected] sweetgreen Contact, Media: Maude Michel [email protected] · Share on Facebook. investor relations, and professional services. While we expect that our At 23, Naomi is sweetgreen's first ever national athlete ambassador and youngest. Investor Relations section of sweetgreen website. The information on our website (or any webpages referenced in this Annual Report on Form K) is not part. Sweetgreen, Inc. Class A Common Stock (SG) SEC Filings Delivered Wednesdays. All Text Fields Are Required. Thanks for submitting! Investor Relations. Sweetgreen, founded in and headquartered in Culver City, California, is a limited-service fast-food chain. Discover more about Sweetgreen. Sweetgreen worked with PwC to implement Oracle Cloud ERP and Coupa, which helped transform its financial and procurement processes to strengthen internal. The sweetgreen app for iOS and Android is the #1 most convenient way to get fresh, craveable, feel-good food on demand. About Us. Careers · Investor Relations · Locations · Press · sweetgreen app · Covid safety. Social Media. Instagram · Twitter · TikTok · Spotify · Facebook. Read press and news articles featuring sweetgreen to learn the latest about the brand. sweetgreen Contact, Investor Relations: Rebecca Nounou [email protected] sweetgreen Contact, Media: Maude Michel [email protected] · Share on Facebook. investor relations, and professional services. While we expect that our At 23, Naomi is sweetgreen's first ever national athlete ambassador and youngest. Investor Relations section of sweetgreen website. The information on our website (or any webpages referenced in this Annual Report on Form K) is not part. Sweetgreen, Inc. Class A Common Stock (SG) SEC Filings Delivered Wednesdays. All Text Fields Are Required. Thanks for submitting! Investor Relations.

Rebecca Nounou's Post. View profile for Rebecca Nounou, graphic. Rebecca Nounou. vp, head of investor relations + chief of staff @ sweetgreen. investor relations. 0—Overview · 1—Newsroom · 2—Events + Presentations · 3—Stock Info · 4—Governance · 5—Financials · 6—Resources · 0—Overview · 1—Newsroom · 2—. The ultimate goal is to provide a clear understanding of Sweetgreen's overall worth, which can help investors make informed investment decisions. There are. contact us to learn more. Questions for the Investor Relations department can be emailed to [email protected] or submitted by clicking on the button below. Sweetgreen has raised a total funding of $M over 11 rounds from 43 investors. Investors include T. Rowe Price, Fidelity Investments and 41 others. Access Sweetgreen Inc (SG) Investor Relations material, such as Live Earnings Calls, Transcripts, Slides, Reports, and Estimates using Quartr. the Investor Relations section of sweetgreen website. The information on our website (or any webpages referenced in this Annual Report on Form K) is not. sweetgreen Contact, Investor Relations: Rebecca Nounou. [email protected] sweetgreen Contact, Media: [email protected] 6. SWEETGREEN, INC. AND SUBSIDIARIES. Rebecca Nounou's Post. View profile for Rebecca Nounou, graphic. Rebecca Nounou. vp, head of investor relations + chief of staff @ sweetgreen. Sweetgreen, Inc. (NYSE:SG) Q2 Earnings Call August 8, PM ET Company Participants Rebecca Nounou - Investor Relations Jonathan Neman - Co. investor relations. 0—Overview · 1—Newsroom · 2—Events + Presentations · 3—Stock Info · 4—Governance · 5—Financials · 6—Resources · 0—Overview · 1—Newsroom · 2—. Sweetgreen to Announce Second Quarter Results on August 8, · 7/11/24 AM ET ; Sweetgreen to Participate at Upcoming Investor Conferences · 5/29/ Sweetgreen believes that food can be both healthy and delicious, high-quality and Investor Relations. © Red Sea Ventures. All Rights Reserved. of Sweetgreen Inc against its peers. Discuss the investment returns and shareholder value creation Head of Investor Relations. Rebecca Nounou. VP & Head of. Key Executives ; Adrienne Gemperle, Chief People Officer ; Rossann Williams, Chief Operating Officer ; Rebecca Nounou, Head of Investor Relations ; Michael Kotick. Head of Investor Relations + Chief of Staff @ sweetgreen · Rebecca Nounou Location · Rebecca Nounou Work · Rebecca Nounou Summary. Sweetgreen, Inc. (SG). Q2 Earnings Call. August 8, ET. Company Participants. Rebecca Nounou - Investor Relations. Jonathan Neman - Co-. Investor Relations: forc-it.ru Q4 Earnings Report: forc-it.ru Sweetgreen is offering 13,, shares of its Class A common stock. The shares are expected to begin trading on the New York Stock Exchange on November Investor Relations · Locations · Press · sweetgreen app · Covid safety. Social Media. Instagram · Twitter · TikTok · Spotify · Facebook. Support + Services.

Individual Dental Plans In Michigan

Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. A PPO plan gives you the freedom to visit any dentist, whether they are in-network or out-of-network. Spirit Dental partners with Ameritas to provide access to. Individual adult dental plans · Individual pediatric dental plans · Low Plan: Delta Dental PPOTM (Standard) · High Plan: Delta Dental PPOTM (Point-of-Service). Avia Dental Plan offers the deepest discounts on most dental procedures at the dentist, including routine cleanings and preventative dental care, major dental. FOR INDIVIDUALS AND FAMILIES Golden Dental Plans has been providing Southeast Michigan residents with one of the best managed care dental plans available. MI Individual & Family Dental Insurance Plans · Denali Dental · Spirit Dental · Primestar Dental · Renaissance Dental · Humana Dental. Number of dentists in. DELTA DENTAL PLAN OF MICHIGAN, INC. forc-it.ru DENCAP DENTAL PLANS, INC. forc-it.ru DENTAL CARE PLUS, INC. WELCOME DENTAL PLAN FOR INDIVIDUAL AND FAMILIES Welcome Dental Plan is the most complete and affordable dental care available in Metro Detroit and Michigan. Seven Michigan dental insurance carriers currently offer plans through the exchange, including Delta Dental of Michigan, BCBS of Mutual Michigan, and Humana. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. A PPO plan gives you the freedom to visit any dentist, whether they are in-network or out-of-network. Spirit Dental partners with Ameritas to provide access to. Individual adult dental plans · Individual pediatric dental plans · Low Plan: Delta Dental PPOTM (Standard) · High Plan: Delta Dental PPOTM (Point-of-Service). Avia Dental Plan offers the deepest discounts on most dental procedures at the dentist, including routine cleanings and preventative dental care, major dental. FOR INDIVIDUALS AND FAMILIES Golden Dental Plans has been providing Southeast Michigan residents with one of the best managed care dental plans available. MI Individual & Family Dental Insurance Plans · Denali Dental · Spirit Dental · Primestar Dental · Renaissance Dental · Humana Dental. Number of dentists in. DELTA DENTAL PLAN OF MICHIGAN, INC. forc-it.ru DENCAP DENTAL PLANS, INC. forc-it.ru DENTAL CARE PLUS, INC. WELCOME DENTAL PLAN FOR INDIVIDUAL AND FAMILIES Welcome Dental Plan is the most complete and affordable dental care available in Metro Detroit and Michigan. Seven Michigan dental insurance carriers currently offer plans through the exchange, including Delta Dental of Michigan, BCBS of Mutual Michigan, and Humana.

The DentalVision plan utilizes the Delta Dental PPO Plus Premier TM network for dentists and VSP's Choice network for eye doctors for more benefits at lower. With no waiting period for preventive dental care, and for basic and major procedures when you switch plans, our PPO plan offers immediate dental coverage. DENCAP Dental Plans is a dental insurance provider offering affordable coverage to individuals and families in Southeastern Michigan. They have been serving. Get a quote on Michigan dental insurance plans from HealthMarkets. Learn more about benefits and options in Michigan. MyPriority Delta Dental insurance is available as an add-on for individuals and families with MyPriority medical plans. Find dental insurance plans for individuals and families If you're looking for a dental insurance plan that's most affordable for you, you'll find a variety. Individual dental insurance plans · Delta Dental PPO™. Delta Dental PPO is our preferred-provider option program. · Delta Dental Premier®. Delta Dental Premier is. The State Dental Plan provides you the opportunity to see any provider you choose, regardless of whether that provider participates in Delta Dental's networks. If you pick a health plan without dental benefits, you can still get a separate dental plan. Notice: IMPORTANT: You can't buy a Marketplace dental plan unless. At forc-it.ru, we offer affordable dental insurance plans with NO waiting for services, so you can save on your next dental visit. Our individual. Michigan dental insurance guide. Michigan's health insurance Marketplace has certified individual and family dental plans from six insurers. Searching for affordable dental insurance in Michigan? Compare MI dental plans and insurance, and find options that can save you between 10%%. We are Detroit Proud! DENCAP Dental Plans has been providing dental insurance to individuals and their families since The DENCAP Customer Service Staff is. Michigan Dental Plan Comparison ; Basic, 80%, 80% up to MAC*, 60%, 50% up to MAC*. Or call Delta Dental of Michigan at or visit forc-it.ru To check your dental plan, call Blue Cross Complete of Michigan's Customer. Individual Dental Plans. Keep your smile healthy with dental benefits from Delta Dental. Delta Dental is one of America's largest, most experienced dental. Full coverage dental insurance includes plans that help cover you for preventive care, as well as basic and major restorative care, and in some cases. The University of Michigan dental plan, administered by Delta Dental of Michigan, is designed to promote regular dental visits and good oral health. Individual Dental Plans. Graduated plans—no EHB, no benefit waiting periods. Keep your smile healthy with dental benefits from Delta Dental. Delta Dental is. Michigan Dental Plan Comparison ; Basic, 80%, 80% up to MAC*, 60%, 50% up to MAC*.

1 2 3 4 5 6