forc-it.ru

Community

State Life Insurance Calculator

Discover your life insurance needs with our Life Insurance Calculator. Get personalized coverage options and protect your loved ones today! Calculate now. Probate costs cover a state's legal fees for disbursing the assets of the deceased. You may incur significant probate costs, depending on your state of. Calculator · Policy Select Policy · Gender: Select Gender · Your Age: Select Age · Spouse Age: Select Age · Term of Assurance · Premium Payment Mode: Select. Voluntary Group Term Life Insurance Premium Calculator. Employees can The Ohio State University Human Resources logo. Human Resources. North. Get started with simple quotes with Corebridge Direct. Get a quote States Life Insurance Company in the City of New York (US Life). Securities. calculator may vary due to user input and assumptions. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in. Bankrate's life insurance calculator helps you hone in on the factors that affect the level of life insurance coverage you may want to buy. skip to page content. U.S. flag. An official website of the United States government. Here's how you know. Dot gov. forc-it.ru means it's official. Use this calculator to determine an individual's Group Life Insurance premium. Choose your employer type to get started. Discover your life insurance needs with our Life Insurance Calculator. Get personalized coverage options and protect your loved ones today! Calculate now. Probate costs cover a state's legal fees for disbursing the assets of the deceased. You may incur significant probate costs, depending on your state of. Calculator · Policy Select Policy · Gender: Select Gender · Your Age: Select Age · Spouse Age: Select Age · Term of Assurance · Premium Payment Mode: Select. Voluntary Group Term Life Insurance Premium Calculator. Employees can The Ohio State University Human Resources logo. Human Resources. North. Get started with simple quotes with Corebridge Direct. Get a quote States Life Insurance Company in the City of New York (US Life). Securities. calculator may vary due to user input and assumptions. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in. Bankrate's life insurance calculator helps you hone in on the factors that affect the level of life insurance coverage you may want to buy. skip to page content. U.S. flag. An official website of the United States government. Here's how you know. Dot gov. forc-it.ru means it's official. Use this calculator to determine an individual's Group Life Insurance premium. Choose your employer type to get started.

Use the Mutual of Omaha Life Insurance Calculator to determine your Life Insurance Needs year level term with return of premium: ICC13LP or state. CALCULATE YOUR NEEDS. How much would you need to leave behind? Estimate your coverage needs with our life insurance calculator. Fast, private. Federal State and Local Governments · Indian Tribal Governments · Tax Exempt You must calculate the taxable portion of the premiums for coverage that exceeds. A life insurance policy can help you give your family financial peace of mind if you are no longer there to provide for them. Get a free quote today. Our term life insurance calculator is a helpful tool to provide a personalized life insurance quote and estimated amount of coverage to fit your needs. 2) World Population Review: forc-it.ru Get Your Life Insurance Quote! Life insurance may be one of. Explore a diverse range of life, health, corporate, group, bancassurance, and takaful plans designed to simplify and streamline your insurance journey. Optional Life Insurance Calculator. The monthly rate for member and spouse coverage is determined by © Missouri State Employees' Retirement System. With our Select Term Life insurance, you can choose between 10, 20, or 30 years of coverage and a guaranteed benefit. You pick the length of time depending on. See how the life insurance carried into retirement will change over time. Instructions. Enter the information below and click on the Calculate button to get a. Our life insurance calculator can help. Just answer some simple questions and we'll estimate your need for you. This insurance needs calculator takes your marital status, age and life stage into account to help you estimate how much insurance you may need. Use the USAA life insurance calculator to estimate how much coverage you should have. Answer a few questions, and we will provide your life insurance needs. Ladder's life insurance calculator can help you estimate how much coverage you need based on debt, mortgage payments, marital status, and more. Do you know how much life insurance you need? Use our life insurance calculator to find out and get a personalized estimate. State Farm life insurance helps cover you with offerings such as term, whole and universal life insurance. Get a quote. Enter the information in the form below to calculate your life insurance needs. Click on the "More Info" button next to each entry to view details. Life Insurance Calculator. How much life insurance do I need? I was born on State Life Insurance Company (Springfield, MA ). Securities. states. This is an estimate only and not an offer of insurance coverage. Please consult with your insurance professional to determine the amount of life. The Standard is a marketing name for Standard Insurance Company (Portland, Oregon), licensed in all states except New York, and The Standard Life Insurance.

Business Loan With 550 Credit Score

In some cases, even startups with credit challenges may be able to qualify for an SBA loan. One option for new businesses is the SBA Microloan program, which. While you technically can get approved for a loan with a credit score, you'll likely face more challenges and pay significantly more for the loan. As a good rule of thumb, you must have a credit score of or higher to be eligible for the loan programs. In general, you can expect a better chance of having your SBA loan approved if your credit score is in the high s. However, some SBA loan programs will. Bad credit business loans work by providing funding to small businesses with less-than-perfect credit scores. Lenders may look at other factors, such as. Loan amounts range from $2, to $35, Once approved, funds can be deposited into your bank account as early as the next business day. credit score minimum. 10% equity infusion is required for a full change in ownership. You will need to use an SBA 7(a) loan. Bad credit business loans are types of financing options that small business owners can access with a minimum credit score below These loan options are. iCapital Funding offers a wide range of business loans for those with bad credit. If you have a bad credit score and own a business you are eligible for a. In some cases, even startups with credit challenges may be able to qualify for an SBA loan. One option for new businesses is the SBA Microloan program, which. While you technically can get approved for a loan with a credit score, you'll likely face more challenges and pay significantly more for the loan. As a good rule of thumb, you must have a credit score of or higher to be eligible for the loan programs. In general, you can expect a better chance of having your SBA loan approved if your credit score is in the high s. However, some SBA loan programs will. Bad credit business loans work by providing funding to small businesses with less-than-perfect credit scores. Lenders may look at other factors, such as. Loan amounts range from $2, to $35, Once approved, funds can be deposited into your bank account as early as the next business day. credit score minimum. 10% equity infusion is required for a full change in ownership. You will need to use an SBA 7(a) loan. Bad credit business loans are types of financing options that small business owners can access with a minimum credit score below These loan options are. iCapital Funding offers a wide range of business loans for those with bad credit. If you have a bad credit score and own a business you are eligible for a.

A bad credit business loan is a type of loan typically accessed by borrowers with lower than a FICO credit score. BayFirst Bolt SBA 7a Loan: Our Fastest Funded Loan · Two years in business · + credit score. But not every business owner can qualify for a business loan from a bank. They may not have a high enough credit score, or they haven't been in business long. Get a merchant cash advance fast · Low minimum credit score of + required. · You must have been in business for 6 months or more. · $15,+ average monthly. We researched the best small business loans for bad credit borrowers based on rates, terms, and more. If your credit score is preventing funding. Traditional bank loans · Microloan · Fintech lenders · Merchant cash advance · Business credit card · Home equity line of credit · Revenue-based loan · Friends and. If your business is strong, growing and has positive long-term prospects, you might still be able get a loan even if you have a bad credit score. Here are 5 Ways to Get a Business Loan if You Have Poor Credit · 1. Pledge a cash down payment. Businesses that have adequate cash flow despite poor credit are. Bad credit often refers to a FICO score of to A lower FICO score is one of the most common reasons as to why a traditional lender would reject small-. While every type of loan is different, a credit score of over is typically required for traditional bank loans. In contrast, many alternative business loan. A Merchant Cash Advance (or Working Capital Advance) is your best chance of getting approved for funding with bad credit. This option only requires a minimum. What is the minimum credit score to get a business loan? Clarify recommends that borrowers have a credit score of at least If your credit score is below. Obtaining a bad credit business loan can be difficult, especially when there are credit challenges below the FICO score range. You qualify for a business loan even if you have a poor credit history. As long as the borrower has a minimum credit score above you can receive an. to This credit score will take you out of the running for most SBA loans, as well as loan products from many affordable alternative lenders. That said. Obtaining a bad credit business loan can be difficult, especially when there are credit challenges below the FICO score range. Upstart may be a good option if you have minimal credit history or poor credit since its minimum credit score requirement is just With an Upstart loan, you. Busy practice owners enjoy the flexibility and speed of our business line of credit loan. Personal FICO score. One month in business icon. 1 month in. Two examples of alternative lenders are business credit card providers and microloans. Another alternative lending option is private loans or marketplace. Traditional bank loans · Microloan · Fintech lenders · Merchant cash advance · Business credit card · Home equity line of credit · Revenue-based loan · Friends and.

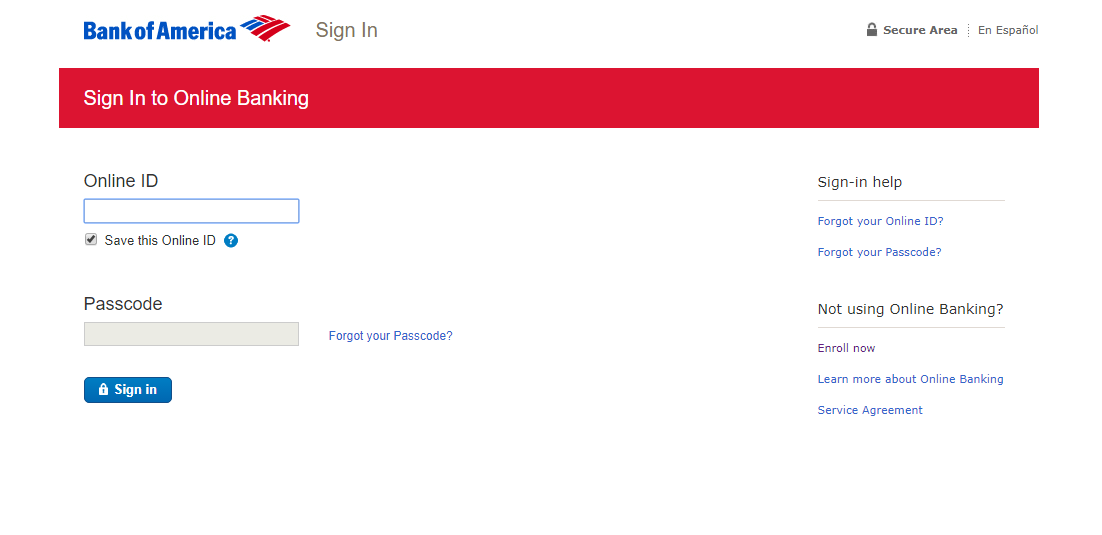

Bank Of America Account Login

Log in to Online Banking Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account. The Bank of America Chicago Marathon is a world class running event returning to the streets of Chicago on Sunday, October 8, Verify your identity in the app now to Log In to Online Banking. Check your mobile device. If you're enrolled in this security feature, we sent a notification. Only log in to your Bank of America account through the mobile app or the official forc-it.ru website. If the alert message was legitimate, you'll see. Log in to Mobile & Online Banking to access your personal and small business accounts, see balances, transfer funds, pay bills and more. SIGN IN MENU. RBC. Ask your question. Close search. Accounts. Accounts. Accounts We'll suggest the best bank account and credit card based on your needs. Manage your account and view key information from your mobile device. The GCA App is available for both iOS and Android. SIGN IN MENU. RBC Logo. Ask your question. Close search. Accounts. Accounts Managing Your Bank Account. Wire Transfer · International Money Transfer. Close Drawer: Secure Log in ×. Log in. Link your Bank of America Private Bank accounts. Secure Log in. Secure Log in. User ID. User ID. Password. Save User ID. Log in to Online Banking Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account. The Bank of America Chicago Marathon is a world class running event returning to the streets of Chicago on Sunday, October 8, Verify your identity in the app now to Log In to Online Banking. Check your mobile device. If you're enrolled in this security feature, we sent a notification. Only log in to your Bank of America account through the mobile app or the official forc-it.ru website. If the alert message was legitimate, you'll see. Log in to Mobile & Online Banking to access your personal and small business accounts, see balances, transfer funds, pay bills and more. SIGN IN MENU. RBC. Ask your question. Close search. Accounts. Accounts. Accounts We'll suggest the best bank account and credit card based on your needs. Manage your account and view key information from your mobile device. The GCA App is available for both iOS and Android. SIGN IN MENU. RBC Logo. Ask your question. Close search. Accounts. Accounts Managing Your Bank Account. Wire Transfer · International Money Transfer. Close Drawer: Secure Log in ×. Log in. Link your Bank of America Private Bank accounts. Secure Log in. Secure Log in. User ID. User ID. Password. Save User ID.

Online banking. Log in to your account(s). hour banking. Call USBANKS American Express is a federally registered service mark of American Express. Transfers can be set up between your Bank of America accounts, Merrill Edge accounts or your accounts at other banks [Bank of America login screen appears. A nationally chartered bank providing access to some of the highest CD (certificate of deposit) rates in the industry along with high-yield savings accounts. Log in to your Online Banking account by entering your User ID. Sign in and access your BofA Private Bank account. Login and get access to all the account features and benefits online. Get all the help you need and see. Verify your identity in the app now to Log In to Online Banking. Check your mobile device. If you're enrolled in this security feature, we sent a notification. JavaScript must be enabled to experience the American Express website and to log in to your account. Amex. American Express US. FREE – In Google Play. View. BMO Canada offers a wide range of personal banking services including chequing and savings accounts, mortgages, credit cards, loans, investments and. If you would like more information about Works, please contact your Bank of America representative. user names or accounts, that may prevent this from. Westamerica Bank is a regional community bank with over 70 branches and 2 Access Your Account. Log in to StarConnect Plus™ Online Banking. Using Bill Pay is easy. Set up one-time or recurring payments with Bill Pay. You can even pay other financial institutions using your Bank of America accounts. Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts • View account balances and review activity. Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts •View account balances and review. Important: If you still have a Bank of America debit card with EDD benefits No personal bank account required. Woman withdrawing cash from an ATM. The email address you enter will become your username to login with. Bank of America receives during the account creation process. You further. Sign into your My TD account to access and manage your bank accounts TD Bank America's most convenient bank. Log In Open Menu. Log In. TD Bank. Clients can review their account balances and transactions, deposit checks and tranfer money through online banking and mobile banking apps for iPhone, iPad. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». I recently got this message when trying to log in to my online banking for Bank of America: Online "Banking is not available to you at this. You can link your bank account instantly by entering your bank login details. We'll use a third-party provider to confirm your bank account details.

How Long Would It Take To Lose 25 Pounds

To lose 25 lbs. of fat in four months, aim for about 1 1/2 lbs. of weight loss a week, or a little more than 6 lbs. each month. And it's not just a little weight — it's a loss of 10 pounds or 5% of your body weight in six to 12 months. It can be a symptom of a serious illness, like. Very slow and gradual calorie deficit: 2 years. Moderate workout and healthy eating: 1 year. Intense workout and diet: 8 months. Borderline Starvation: 5. I lost 25 pounds!! These 6 Foods will Burn Fat, Kill Cancer and Heal Body | Dr. Mindy Pelz, Top Fasting Expert. Healthy Long Life•K views. You can lose 25 ibs safely in about months if intensive. But honestly this shouldn't be a race. Know you are worthy. And don't feel ashamed. Unlike body weight, where no more than two pounds per week of loss is recommended, there are no standards or guidelines for how quickly to lose body fat or gain. To achieve this in eight weeks, you'll need to -- on average -- create a deficit of 1, calories every day. Video of the Day. On today's episode of Live Lean TV, I'm answering the question, can you lose 25 pounds in 6 weeks? Well, the quick answer is yes. Using this guideline, it could take approximately weeks (or months) to lose 25 pounds. However, it's important to note that the rate of weight loss. To lose 25 lbs. of fat in four months, aim for about 1 1/2 lbs. of weight loss a week, or a little more than 6 lbs. each month. And it's not just a little weight — it's a loss of 10 pounds or 5% of your body weight in six to 12 months. It can be a symptom of a serious illness, like. Very slow and gradual calorie deficit: 2 years. Moderate workout and healthy eating: 1 year. Intense workout and diet: 8 months. Borderline Starvation: 5. I lost 25 pounds!! These 6 Foods will Burn Fat, Kill Cancer and Heal Body | Dr. Mindy Pelz, Top Fasting Expert. Healthy Long Life•K views. You can lose 25 ibs safely in about months if intensive. But honestly this shouldn't be a race. Know you are worthy. And don't feel ashamed. Unlike body weight, where no more than two pounds per week of loss is recommended, there are no standards or guidelines for how quickly to lose body fat or gain. To achieve this in eight weeks, you'll need to -- on average -- create a deficit of 1, calories every day. Video of the Day. On today's episode of Live Lean TV, I'm answering the question, can you lose 25 pounds in 6 weeks? Well, the quick answer is yes. Using this guideline, it could take approximately weeks (or months) to lose 25 pounds. However, it's important to note that the rate of weight loss.

Quick Rule of Thumb on Calories: Each pound is equivalent to 3, calories, so a calorie daily deficit would lead to losing 1 pound per week. Weighing Your. It will go along the lines of this: "If you are in a calorie deficit of calories per day, then you will achieve one pound weight loss per week. At this rate. And to lose weight, the calories you burn or expend must exceed the ones you consume daily. This is the basic principle that determines all the strategies that. Losing Weight Too Quickly Can Damage Your Metabolism If you lose more than about 8 pounds in a month, not only will you likely not be able to keep it off, but. Take a minute, plug your information into the weight loss calculator and discover the maximum daily calorie amount that will help you lose 1 pound per week. Losing 25 pounds in two months will be difficult. You'll need to make a variety of changes to your diet and lifestyle. How long will my dog need to be on a diet? Each dog is an individual the rate of weight loss (e.g., losing 1% will take twice as many weeks as 2%); and. Though weight loss may occur faster at the start of a program, experts recommend a weight loss of 1–3 pounds (– kg) per week, or about 1% of your body. At a weight loss rate of ½ -1 pound per week, it will likely take you at least 20 weeks to lose 20 pounds. Losing weight at this pace is safe and will help you. How long will my dog need to be on a diet? Each dog is an individual the rate of weight loss (e.g., losing 1% will take twice as many weeks as 2%); and. Losing weight safely typically involves losing pounds per week. This would allow you to lose 20 pounds within about 5 months at 1 pound per week or 2 1/2. lose weight. And be smart about what you're putting in your body. This is the routine that worked for me (running + calisthenics basics). With that in mind, if you consistently eat at a deficit of calories a day you can expect to lose a pound a week, which is a good number to aim for. Losing. Read on to learn all about how to safely lose weight after having a baby and how long that might take, as well as how breastfeeding can help shed some pounds. Your goal should be to lose lbs per week. It's also important to remember that combining a small caloric deficit with exercise is the best way to maximize. Losing 25 pounds in two weeks is possible, but it's not a long-term solution. Losing weight quickly is an effective way to lose weight, but you're more likely. Sleep is the unsung hero of weight loss. Studies have shown that people who get six to eight hours of sleep a night are much more successful at losing weight. She should take supplements like vitamins and use them to substitute for high-fat foods. b. She should set a more gradual goal and plan a diet and exercise. How long does it take to lose 30 pounds? Assuming your goal is to lose 1 or 2 pounds a week, it'll take about 4 months to lose 30 pounds. To do so, eat lots. Sleep is the unsung hero of weight loss. Studies have shown that people who get six to eight hours of sleep a night are much more successful at losing weight.

Investment Platforms For Beginners

These investing sites for beginners provide user-friendly interfaces, educational resources, and many investment options to help kickstart their investment. eToro is a trading platform that offers investing in stocks and cryptoassets, as well as trading CFDs. With eToro, beginners and expert traders in the UK have. 7 Best Investment Apps for Beginners · SoFi Invest · Investr · Betterment · Robinhood · Acorns · Ellevest · Suma Wealth · You May Also Like. Powerful Trading Platforms To Help You Succeed · Award winning platforms for every investor from beginner to advanced on mobile, web and desktop. · Discover new. Overview: Top online brokers for beginners in September · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-trade Financial. Interactive Investor has a wide range of information, including beginners' guides on a range of investments and a glossary of terms you might come across while. Schwab is a leader among discount brokers for its educational and research materials, extensive investing and trading tools, and the ease with which clients can. Top 10 Low-Cost Investment Platforms for Beginners · SoFi Invest · 9. Stash · 8. Merrill Edge · 7. Wealthfront · 6. Betterment · 5. E*TRADE · 4. Charles Schwab · 3. Our top five investment platforms for beginners. Below we've listed our top five investment platforms on the market. These investing sites for beginners provide user-friendly interfaces, educational resources, and many investment options to help kickstart their investment. eToro is a trading platform that offers investing in stocks and cryptoassets, as well as trading CFDs. With eToro, beginners and expert traders in the UK have. 7 Best Investment Apps for Beginners · SoFi Invest · Investr · Betterment · Robinhood · Acorns · Ellevest · Suma Wealth · You May Also Like. Powerful Trading Platforms To Help You Succeed · Award winning platforms for every investor from beginner to advanced on mobile, web and desktop. · Discover new. Overview: Top online brokers for beginners in September · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-trade Financial. Interactive Investor has a wide range of information, including beginners' guides on a range of investments and a glossary of terms you might come across while. Schwab is a leader among discount brokers for its educational and research materials, extensive investing and trading tools, and the ease with which clients can. Top 10 Low-Cost Investment Platforms for Beginners · SoFi Invest · 9. Stash · 8. Merrill Edge · 7. Wealthfront · 6. Betterment · 5. E*TRADE · 4. Charles Schwab · 3. Our top five investment platforms for beginners. Below we've listed our top five investment platforms on the market.

Whether you're a beginner looking to start your investing journey with an intuitive, easy-to-use investment platform, or an experienced trader looking for. Top picks for investment platforms. Plus logo. An awesome platform The best trading platforms for beginners · What's the best way to invest money. Alternative investments, now for the rest of us. · Learn more about investing. One of the most popular and appropriate platform for beginners is Bitget, it seeks to cater to relatively new traders through its frameworks. Here are four brokers or trading platforms that are worth considering for beginners in the US: eToro, Why Did We Pick It? is renowned for its user-friendly. Schwab, Fidelity, and Vanguard are all well respected in this community. Other alternatives exist as well and may be just a good. Take the trading muscle of Power E*TRADE web, and put it in your pocket. Trade stocks, ETFs, options, and futures on a single ticket. Learn more. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. Hatch: Best App or Platform for New Zealanders Growing their Portfolio while Learning About Investing · Tiger Brokers (NZ): Best Low-Cost Shares Platform. Fidelity is our top pick overall, with something to offer long-term seasoned investors and beginners alike. It's a full-service broker with a broad range of. Fidelity is the best international investing platform for beginners, with one account for both U.S. and global trading. Yet, Fidelity also allows for trading. The best trading platforms offer traders a way to place orders, track a watchlist of stocks, commodities, cryptos, currencies, and funds. The best trading platforms offer traders a way to place orders, track a watchlist of stocks, commodities, cryptos, currencies, and funds. If however, you prefer to have the heavy lifting handled by investing professionals, then a full-service brokerage firm may be a better choice. Firms such as. Whether you're a seasoned trader or just starting your investment journey, Webull's feature-rich platform, coupled with its commitment to zero-commission. An approachable platform that offers plenty of trading opportunities for investments of all types, Charles Schwab is a solid choice especially for beginners. DEGIRO — Top pick for low fees and broad access to global exchanges; XTB — Excellent option for beginner investors; Trade Republic — Great. Who Should Use eToro? This is a good option for most traders. Beginners in the UK can benefit from the demo account and copy trading, while experienced traders. Learn everything you need to know about choosing a platform to invest and trade on as a beginner – and what makes us a leading provider in the UK. Whether you're a seasoned trader or just starting your investment journey, Webull's feature-rich platform, coupled with its commitment to zero-commission.

How To Calculate Your Credit Utilization Ratio

Calculating your credit utilization ratio is a snap. Simply “divide the balance of all your revolving debt by the total amount of revolving credit available to. To calculate your credit utilization ratio, divide your current balance amount on any card by your credit limit. To determine your total utilization ratio. To calculate your credit utilization ratio, tally your outstanding debt across all revolving credit accounts. Next, add the credit limits of each individual. This ratio accounts for 30% of your credit score calculation and tells your future lenders about how you use your credit. How do I calculate my credit. The way to calculate it is simple: simply divide each credit card balance by its credit limit, then add them all together and do the calculation again based on. Then your credit utilisation ratio is calculated by dividing the total outstanding on both the cards (Rs, + Rs.0) with the total credit limit on the cards. Your credit utilization ratio is the amount you owe across your credit cards compared to your total credit line available, expressed as a percentage. The ratio is calculated by dividing the total balance by the total limit. Because an outstanding balance will never exceed the total limit, this results in a. To find your utilization rate, divide your total balance ($4,) by your total credit limit ($20,). Then, multiply by to get the percentage. Here's the. Calculating your credit utilization ratio is a snap. Simply “divide the balance of all your revolving debt by the total amount of revolving credit available to. To calculate your credit utilization ratio, divide your current balance amount on any card by your credit limit. To determine your total utilization ratio. To calculate your credit utilization ratio, tally your outstanding debt across all revolving credit accounts. Next, add the credit limits of each individual. This ratio accounts for 30% of your credit score calculation and tells your future lenders about how you use your credit. How do I calculate my credit. The way to calculate it is simple: simply divide each credit card balance by its credit limit, then add them all together and do the calculation again based on. Then your credit utilisation ratio is calculated by dividing the total outstanding on both the cards (Rs, + Rs.0) with the total credit limit on the cards. Your credit utilization ratio is the amount you owe across your credit cards compared to your total credit line available, expressed as a percentage. The ratio is calculated by dividing the total balance by the total limit. Because an outstanding balance will never exceed the total limit, this results in a. To find your utilization rate, divide your total balance ($4,) by your total credit limit ($20,). Then, multiply by to get the percentage. Here's the.

It affects 30% of your FICO Score, the most popular credit score used by lenders. It is used by credit reporting agencies when determining your credit score. How to calculate your credit utilization rate Your credit utilization rate (also known as your credit utilization ratio or debt-to-credit ratio) measures how. Do the Math · 1) Make a list of your revolving accounts · 2) Add up your total credit limit · 3) Add up the balances on each of these cards · 4) Divide the. Here, your credit utilisation ratio is 44%. You can also calculate the credit utilisation ratio for each individual credit card in the same manner. What is. Let's say you have a $ credit card balance, on a card that has a $1, credit limit. On that particular card, you have used half of your available credit—. Basically, your credit utilization ratio is calculated by dividing your current credit balance by your total available credit. So, if you have a balance of. Divide the combined sum of your balances by the total credit limit. Multiply that figure by That will be your credit utilization ratio as a percentage. Or. Your credit utilization ratio is the percentage you use of your entire credit limit, specifically on a loan or credit card. For example, if you have two credit. To assess your current Credit Utilization Ratio, add up all your credit card debt and divide that sum by the total credit limit across all your credit cards. So what is credit utilization ratio? It's the money you owe on your credit cards, divided by your total credit card limit. A good number to aim for is 30% or. To calculate your credit utilization ratio use this simple formula: Divide your total debt on revolving credit by your total available credit limit on your. To calculate your CUR, divide your total outstanding balances across all your cards by your total credit limit. Then, multiply by to get the percentage. For. 1. Credit utilization is calculated by dividing your total credit card balances by your total credit card limits. For example, if you have two credit cards with. One of the factors determining your credit score is your credit utilization ratio, which measures how much of your credit show more. 0. 0. View More. Your credit utilization ratio is typically expressed as a percentage. For example, if you have three credit cards with a total credit line of $10, and you. Credit usage refers to how much of your available credit you're currently using. The three major credit bureaus (Experian, Equifax, and TransUnion) calculate. To calculate your credit utilization ratio, you need to divide your total credit card balances by your total credit limits. For example, if you have a total. Basically, your credit utilization ratio is calculated by dividing your current credit balance by your total available credit. So, if you have a balance of. Divide the total debt by the total credit limit; Multiply the answer by to see your credit utilization rate. For example, let's say you own two credit cards.

Fha Loan Mortgage Companies

First time home buyers, learn more about FHA approved mortgage loans with Orrstown Bank. Contact our lenders today and receive same-day pre-qualification! FHA-approved lenders are able to offer these benefits because borrowers with an FHA loan pay mortgage insurance, which protects the lender in case the borrower. Best FHA Loans of · What Are the Best FHA Mortgage Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. An FHA loan provides a government-insured loan with flexible loan options. Less strict credit requirements and qualifications make this loan the easiest loan. It's easy! Simply apply online now through our WBM Application TM or contact us to speak with one of our friendly FHA loan specialists for a no-obligation. The Federal Housing Administration (FHA) - which is part of HUD - insures the loan, so your lender can offer you a better deal. Low down payments; Low closing. FHA loans require a lower minimum down payment than many conventional loans, and applicants may have lower credit scores than the best mortgage lenders usually. FHA loan requirements and loan limits: Who qualifies? · Minimum credit score: · Minimum down payment: % · Maximum DTI ratio: 43% · FHA mortgage insurance. First time home buyers, learn more about FHA approved mortgage loans with Orrstown Bank. Contact our lenders today and receive same-day pre-qualification! FHA-approved lenders are able to offer these benefits because borrowers with an FHA loan pay mortgage insurance, which protects the lender in case the borrower. Best FHA Loans of · What Are the Best FHA Mortgage Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. An FHA loan provides a government-insured loan with flexible loan options. Less strict credit requirements and qualifications make this loan the easiest loan. It's easy! Simply apply online now through our WBM Application TM or contact us to speak with one of our friendly FHA loan specialists for a no-obligation. The Federal Housing Administration (FHA) - which is part of HUD - insures the loan, so your lender can offer you a better deal. Low down payments; Low closing. FHA loans require a lower minimum down payment than many conventional loans, and applicants may have lower credit scores than the best mortgage lenders usually. FHA loan requirements and loan limits: Who qualifies? · Minimum credit score: · Minimum down payment: % · Maximum DTI ratio: 43% · FHA mortgage insurance.

Compared to conventional mortgages, FHA loans can be easier to qualify for and allow for borrowers with lower credit scores. Here are NerdWallet's top-rated. Texas FHA Loans are perfect for first-time buyers, only % down and easier qualifying. Approved FHA lender in Texas - Low Rate & Low Fees. FHA Loans. At Eagle Mortgage, our FHA Loans product is designed to provide accessible and flexible financing solutions for aspiring homeowners. Backed by the. FHA and VA loans feature low down payment options and flexible credit and income guidelines that may make them easier for first-time homebuyers to obtain. Best FHA loan lenders · Better: Best overall. · Rocket Mortgage: Best for a fully online process. · Chase: Best for on-time closing. · Bank of America: Best for. First time home buyers in Atlanta, Georgia take advantage of the FHA home loan program to buy and finance their very first home. MaineHousing Lenders ; Guild Mortgage Company LLC, , X ; HarborOne Mortgage, , X ; Kennebunk Savings Bank, ; KFS Mortgage. FHA loans are loans from private lenders that are regulated and insured by the Federal Housing Administration (FHA), a government agency. FHA – Streamline – Score – No Appraisal, No Income, No AVM, No Credit Qualifying! FHA – Streamline -Investment and 2nd Homes OK. A long-running and popular option for homebuyers, an FHA home loan is mortgage loan backed by the Federal Housing Administration (FHA) that allows for smaller. A top New Jersey, New York and Pennsylvania Mortgage Company. Catering to First Time Homebuyers offering FHA low down payment loans, USDA and VA loan. FHA-approved lenders are authorized to issue Texas FH loans for the purpose of buying, refinancing, or remodeling a home. The Federal Housing Administration (FHA) does not lend money, but insures loans made through FHA-approved lenders, which reduces their risk if the borrower. GTranslate The link below takes you to the FHA-approved lender search for all FHA lenders. To find reverse mortgage lenders only, you must: Search for. Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas. FHA mortgage home loans are insured by the Federal Housing Administration (FHA) which can make it easier for you to qualify to purchase or refinance a home. They allow borrowers to finance homes with down payments as low as % and are especially popular with first-time homebuyers. FHA loans are a good option for. The Best Mortgage Lenders for FHA Loans · New American Funding: Best overall · Carrington Mortgage Services: Best for low credit scores · Guild Mortgage: Best. With an FHA loan, you'll need 3% – 6% of the purchase price available to cover closing costs. 4. Mortgage Insurance Premium (MIP). You'll pay an upfront.

Law Of Supply And Demand

:max_bytes(150000):strip_icc()/law-of-supply-demand-final-6d3d58ceeb2b462d9a56f2f012641c5f.png)

Key Takeaways · The law of supply and demand is an important concept in economics that explains how the market price of a good or service is reached. · The law. -the law of demand says that at higher prices, buyers will demand less of an economic good. -the law of supply says that at higher prices, sellers will supply. -the law of demand says that at higher prices, buyers will demand less of an economic good. -the law of supply says that at higher prices, sellers will supply. Supply and demand (sometimes called the "law of supply and demand") are two primary forces in markets. The concept of supply and demand is an economic model. The law of supply is essentially the opposite of the law of demand. According to the law of supply, if no other factors change, price is the main factor. The law of supply in conjunction with the law of demand forms the basis for market conditions resulting in a price and quantity relationship at which both the. The Bottom Line. The law of supply and demand centers on prices that change when either the supply of goods and services or the demand for them changes. The law of supply is a fundamental principle of economic theory which states that, keeping other factors constant, an increase in sales price results in an. Economists call this the Law of Demand. If the price goes up, the quantity demanded goes down (but demand itself stays the same). If the price decreases. Key Takeaways · The law of supply and demand is an important concept in economics that explains how the market price of a good or service is reached. · The law. -the law of demand says that at higher prices, buyers will demand less of an economic good. -the law of supply says that at higher prices, sellers will supply. -the law of demand says that at higher prices, buyers will demand less of an economic good. -the law of supply says that at higher prices, sellers will supply. Supply and demand (sometimes called the "law of supply and demand") are two primary forces in markets. The concept of supply and demand is an economic model. The law of supply is essentially the opposite of the law of demand. According to the law of supply, if no other factors change, price is the main factor. The law of supply in conjunction with the law of demand forms the basis for market conditions resulting in a price and quantity relationship at which both the. The Bottom Line. The law of supply and demand centers on prices that change when either the supply of goods and services or the demand for them changes. The law of supply is a fundamental principle of economic theory which states that, keeping other factors constant, an increase in sales price results in an. Economists call this the Law of Demand. If the price goes up, the quantity demanded goes down (but demand itself stays the same). If the price decreases.

Law of Supply and Demand. The common sense principle that defines the generally observed relationship between demand, supply, and prices: as demand increases. The New Law of Demand and Supply: The Revolutionary New Demand Strategy for Faster Growth and Higher Profits [Kash, Rick] on forc-it.ru Just as a shift in demand is represented by a change in the quantity demanded at every price, a shift in supply means a change in the quantity supplied at every. The equilibrium of supply and demand in each market determines the price and quantity of that item. Moreover, a change in equilibrium in one market will affect. The law of supply states that the quantity of a good supplied (i.e., the amount owners or producers offer for sale) rises as the market price rises, and falls. lower per unit price seller want to sell fewer units. Page Reason for ceteris paribus. • When we state the law of supply we. Law of supply and demand definition: the theory that prices are determined by the interaction of supply and demand. See examples of LAW OF SUPPLY AND DEMAND. The law of demand and supply is an economic law that acts as a support system for most economic principles. It determines people's interest in a particular good. Market clearing is based on the famous law of supply and demand. As the price of a good goes up, consumers demand less of it and more supply enters the market. Supply and demand is a microeconomics theory describing the effect that the available level of goods or services has on pricing, buying volume. Supply is generally considered to slope upward: as the price rises, suppliers are willing to produce more. Demand is generally considered to slope downward: at. What is the law of supply and demand? The law of supply and the law of demand are two separate laws that work together to determine the optimal price point of a. Supply and demand are basic economic principles that examine the relationship between the amount of goods or services available and the number of people who. The meaning of LAW OF SUPPLY AND DEMAND is a statement in economics: the competitive price that clears the market for a commodity is determined through the. The law of Supply and Demand is a Mathematically Indeterminable Illusion and does a very poor job of explaining prices. Any student of economics. The law of supply and demand enables a manufacturer or provider to anticipate demand for a product or service and drive more sales while engaging in effective. The law of demand states that the higher the price, the lower the quantity This market equilibrium is not fixed; it is likely to change over time due to. Law of Supply: In almost all cases, the quantity supplied rises when the price rises (holding all else equal). Market: A group of economic agents who are. Like the law of demand, the law of supply shows the quantities that will be sold at a given price. But unlike the law of demand, the supply ratio shows an. The primary corollary of the law of supply and demand is that at every market price, the quantity demanded will equal the quantity supplied, that free markets.

How Can I Find Someone By Their License Plate

According to the Driver's Privacy Protection Act (DPPA) there are some restrictions. In this case, conducting a license plate lookup needs either written. Special group license plates generate funds for specific purposes or honor or recognize specific groups of people. Special group plates have different. How to look up a license plate · Open a web browser · Go to forc-it.ru · Enter the license plate number, and select state · View the report · View images. Available License Plates. For many of the specialty tags, there is an additional fee imposed when you purchase and/or renew the plate. How to look up a license plate · Open a web browser · Go to forc-it.ru · Enter the license plate number, and select state · View the report · View images. There are various online portals where you can purchase additional information such as the vehicle owner's name, address, phone number, social security number. You can use online portals to lookup free, basic information from a license plate such as the make, model, and year. A vehicle license plate search is similar to a VIN check. You type in the license plate number of a given vehicle, and we provide you with information about it. Try an online search service. There are many online services that will comb through public records to find the person who was issued a particular license plate. According to the Driver's Privacy Protection Act (DPPA) there are some restrictions. In this case, conducting a license plate lookup needs either written. Special group license plates generate funds for specific purposes or honor or recognize specific groups of people. Special group plates have different. How to look up a license plate · Open a web browser · Go to forc-it.ru · Enter the license plate number, and select state · View the report · View images. Available License Plates. For many of the specialty tags, there is an additional fee imposed when you purchase and/or renew the plate. How to look up a license plate · Open a web browser · Go to forc-it.ru · Enter the license plate number, and select state · View the report · View images. There are various online portals where you can purchase additional information such as the vehicle owner's name, address, phone number, social security number. You can use online portals to lookup free, basic information from a license plate such as the make, model, and year. A vehicle license plate search is similar to a VIN check. You type in the license plate number of a given vehicle, and we provide you with information about it. Try an online search service. There are many online services that will comb through public records to find the person who was issued a particular license plate.

Long answer: Even though some websites claim it is illegal, we've got some bad news: It is actually legal to find a vehicle owner by their license plate. But. Essentially, plate readers and cameras, which already exist on streets all across the United States, scan the tags of any vehicle that drives past them. That. registration expiration date, the PLP message becomes available to be requested by any other person on the following January 1. If Your PLP Message is. License plates acquired by any person, firm, or corporation for any vehicle vehicle's registration plate recorded by a traffic control monitoring system. Overall, there are two main ways to conduct a license plate lookup in California: through the DMV or through third parties. An application to the DMV allows the. Only a member of law enforcement can run a license plate or lookup license plate numbers to find vehicle owner information. their farm. Documentation from a foreign country that clearly indicates that the person requesting license plates is a duly appointed consul representing that. Although license plates are part of public records, you cannot get personal information about the previous owners of a particular vehicle. Personal data in the. License plate number; Boat Hull Identification Number (HIN); Boat registration Military personnel, veterans, and their spouses · People moving to. License plates, decals, and placards help identify vehicle owners, show proof of registration, grant driving and parking privileges, and more. Did someone gift them the car? Do these 2 people even know about each other? Are there 2 people from 2 different states driving identical cars in the same city. Yes, you can find someone's name from their vehicle plate however, there are restrictions that apply. You can with your state's privacy laws to find what. Essentially, plate readers and cameras, which already exist on streets all across the United States, scan the tags of any vehicle that drives past them. That. their license plate numbers, vehicle identification number (VIN), and more. person, by mail, or through their online services. Replacement license. Yes, it is legal to look up someone's license plate numbers in Texas via GoodCar's search platform. From there, one can view the vehicle history detailing. i got the guys liscence plate number before they turned off and was wondering if there was either a free way to look up who they were or if someone had an. Disabled Person. Disabled Person License Plate. (Motor Vehicle Code Section 66 There is a limit of four Gold Star Family registration plates for each. Looking for a used car? Want to learn more about a passing vehicle? Enter a license plate or VIN and quickly get information on model, year, engine. Search Categories · License - Motorist identification number OR name and date of birth · Registration - Plate number of name and date of birth · Plate number -. Free License Plate Number Lookup · For the last several decades people have had to visit the DMV and take a number. · You can sometimes find limited · Nationwide.

2 3 4 5 6